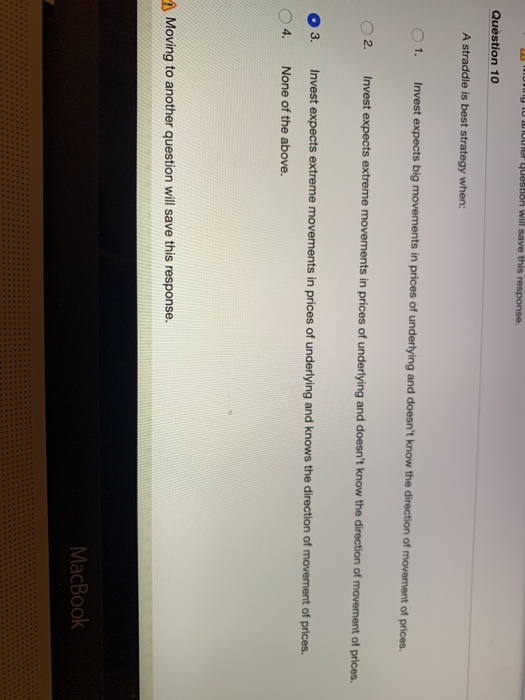

Question: om a er question will save this response. Question 10 A straddle is best strategy when: 1. Invest expects big movements in prices of underlying

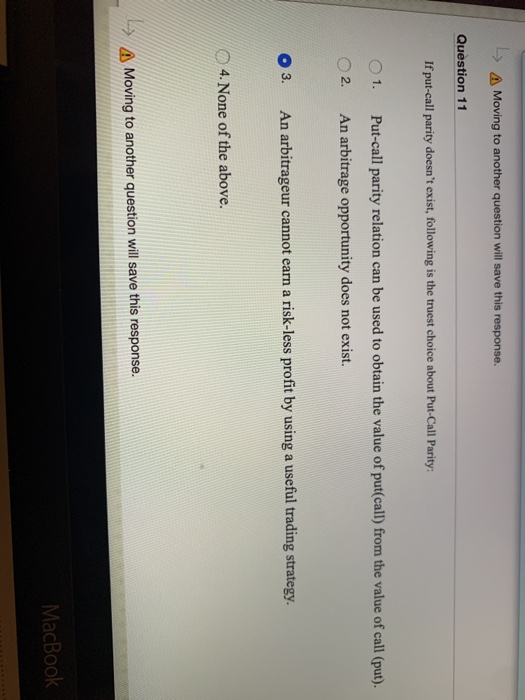

om a er question will save this response. Question 10 A straddle is best strategy when: 1. Invest expects big movements in prices of underlying and doesn't know the direction of movement of prices. 2. Invest expects extreme movements in prices of underlying and doesn't know the direction of movement of prices. 3. Invest expects extreme movements in prices of underlying and knows the direction of movement of prices. 4. None of the above. Moving to another question will save this response. MacBook > Moving to another question will save this response. Question 11 If put-call parity doesn't exist, following is the truest choice about Put-Call Parity: 1. 2. Put-call parity relation can be used to obtain the value of put(call) from the value of call (put). An arbitrage opportunity does not exist. 3. An arbitrageur cannot earn a risk-less profit by using a useful trading strategy. 4. None of the above. > A Moving to another question will save this response. MacBook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts