Question: om document/d/17025 RE pago 00D Submit files. Dropb Numerade Member Services Format Tools Add-ons Help Last edit was 3 minutes ago + BILA Normal text

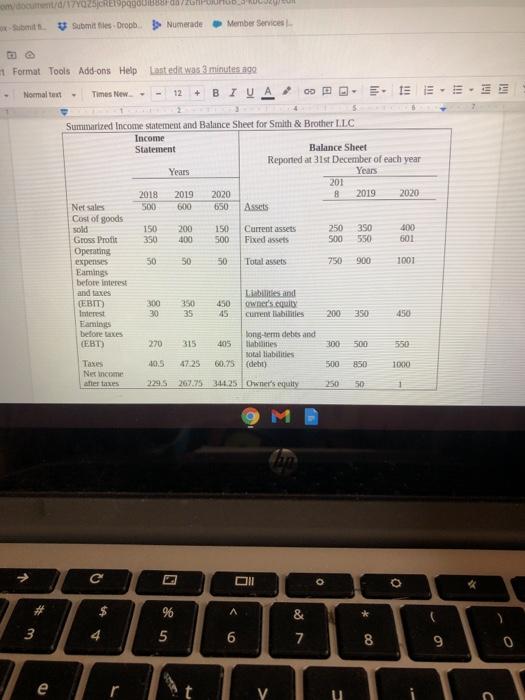

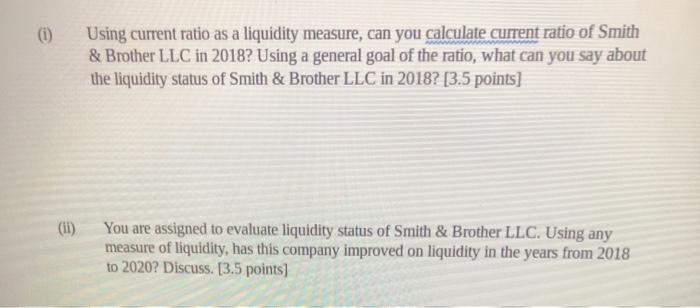

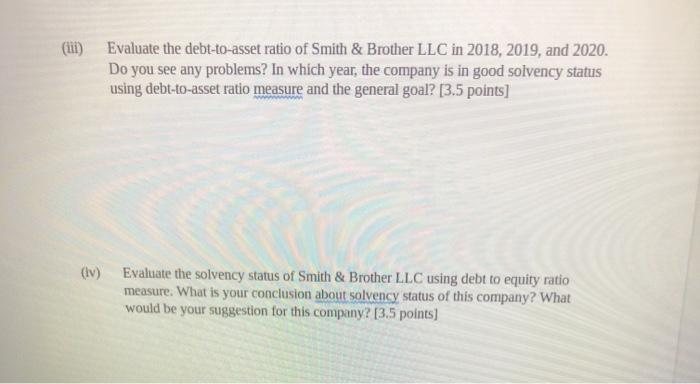

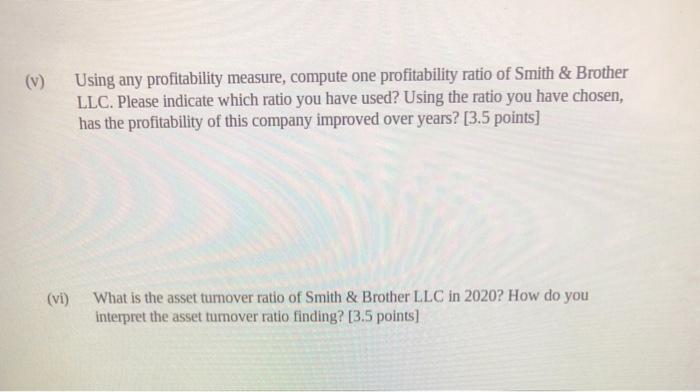

om document/d/17025 RE pago 00D Submit files. Dropb Numerade Member Services Format Tools Add-ons Help Last edit was 3 minutes ago + BILA Normal text Times New 12 IEE-- Summarized Income statement and Balance Sheet for Smith & Brother LLC Income Statement Balance Sheet Reported at 31st December of each year Years Years 201 2018 2019 2020 8 2019 2020 Net sales 500 600 650 Assets Cost of goods sold 150 200 150 Current assets 250 350 400 Gross Profit 350 400 500 Fixed assets 500 550 601 Operating expenses 50 50 50 Total assets 750 900 1001 Earnings before interest and taxes Labtes and (EBIT) 300 350 450 owner's.cquity Interest 30 35 current abilities 200 350 450 Earnings before taxes long-term debts and 270 315 405 liabilities 300 500 550 Total liabilities Taxes 10.5 47.25 60.75 (debu 500 850 1020 Net income after taxes 229,5 207.75 344.25 Owner's equity 250 50 1 EBT) ME 1 C ON 0 O # %6 A & * 3 4 5 6 7 8 9 0 e Y U C (1 ) Using current ratio as a liquidity measure, can you calculate current ratio of Smith & Brother LLC in 2018? Using a general goal of the ratio, what can you say about the liquidity status of Smith & Brother LLC in 2018? [3.5 points] (II ) You are assigned to evaluate liquidity status of Smith & Brother LLC. Using any measure of liquidity, has this company improved on liquidity in the years from 2018 to 2020? Discuss. [3.5 points) (11) Evaluate the debt-to-asset ratio of Smith & Brother LLC in 2018, 2019, and 2020. Do you see any problems? In which year, the company is in good solvency status using debt-to-asset ratio measure and the general goal? [3.5 points] (lv) Evaluate the solvency status of Smith & Brother LLC using debt to equity ratio measure. What is your conclusion about solvency status of this company? What would be your suggestion for this company? [3.5 points) (v) Using any profitability measure, compute one profitability ratio of Smith & Brother LLC. Please indicate which ratio you have used? Using the ratio you have chosen, has the profitability of this company improved over years? [3.5 points] (vi) What is the asset turnover ratio of Smith & Brother LLC in 2020? How do you interpret the asset turnover ratio finding? [3.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts