Question: omework 2 Accruals & Deferrals Saved 22 On August 1, Year 1, Josh Smith, attorney, accepted an $37000 cash advance from his client, James Company,

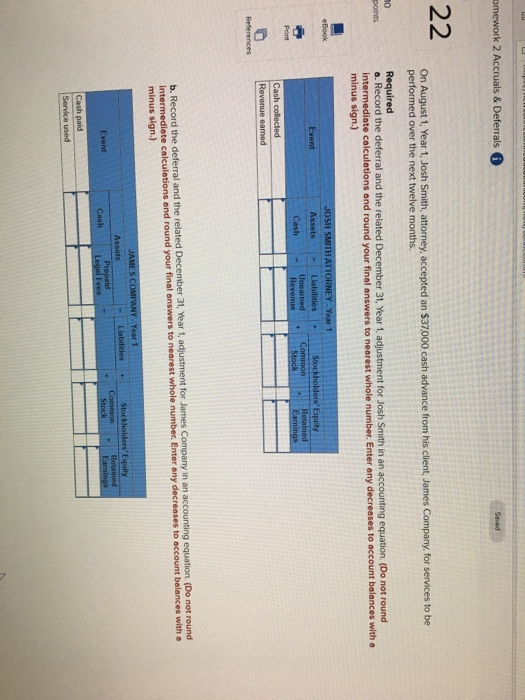

omework 2 Accruals & Deferrals Saved 22 On August 1, Year 1, Josh Smith, attorney, accepted an $37000 cash advance from his client, James Company, for services to be performed over the next twelve months. Required a. Record the deferral and the related December 31, Year 1, adjustment for Josh Smith in an accounting equation. (Do not round intermediate calculations and round your final answers to nearest whole number. Enter any decreases to account balances with a minus sign.) points eBook JOSH SMITH ATTORNEY-Year 1 Stockholders' Equity Retained Earnings Event Assets Liabilities Unearned Revenue Common Stock Cash Print Cash collected Revenue eamed References b. Record the deferral and the related December 31, Year 1, adjustment for James Company in an accounting equation. (Do not round intermediate calculations and round your final answers to nearest whole number. Enter any decreases to account balances with o minus sign.) JAMES COMPANY Year 1 Stockholders' Equity Assets Prepaid Legal Fees Liabilities Common Stock Retained Event Cash Eamings Cash paid Service used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts