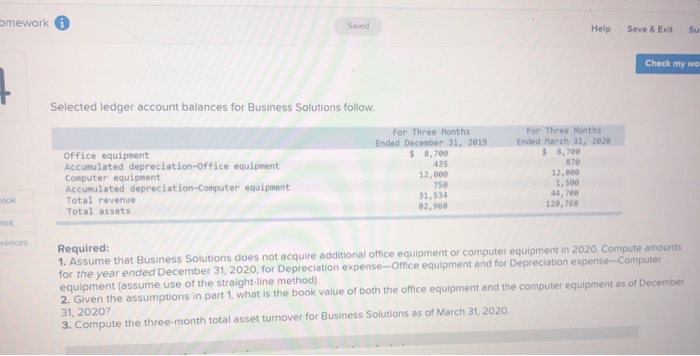

Question: omework Help Save & Exit Su Check my wo Selected ledger account balances for Business Solutions follow, For Three Months Ended December 31, 2019 $

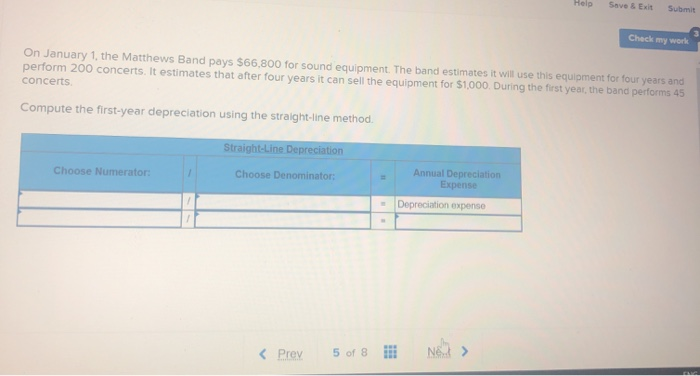

omework Help Save & Exit Su Check my wo Selected ledger account balances for Business Solutions follow, For Three Months Ended December 31, 2019 $ 8,700 435 For Three Months Ended March 31, 2020 $ 3.700 370 12,000 1. Soe 44,00 120,768 Office equipment Accumulated depreciation-office equipment Computer equipment Accumulated depreciation-Computer equipment Total revenue Total assets 12.000 750 sook 31,534 82,960 roncos Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2020. Compute amounts for the year ended December 31, 2020, for Depreciation expense-Office equipment and for Depreciation expense-Computer equipment (assume use of the straight-line method) 2. Given the assumptions in part 1 what is the book value of both the office equipment and the computer equipment as of December 31, 2020? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2020 Help Save & Exit Submit Check my work On January 1, the Matthews Band pays $66.800 for sound equipment. The band estimates it will use this equipment for four years and perform 200 concerts. It estimates that after four years it can sell the equipment for $1,000. During the first year, the band performs 45 concerts Compute the first-year depreciation using the straight-line method Straight-Line Depreciation Choose Numerator: Choose Denominator: Annual Depreciation Expense Depreciation expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts