Question: omework Saved Help Save & Exit Submit Check my work Shep Company's records show the following information for the current year. Beginning of year End

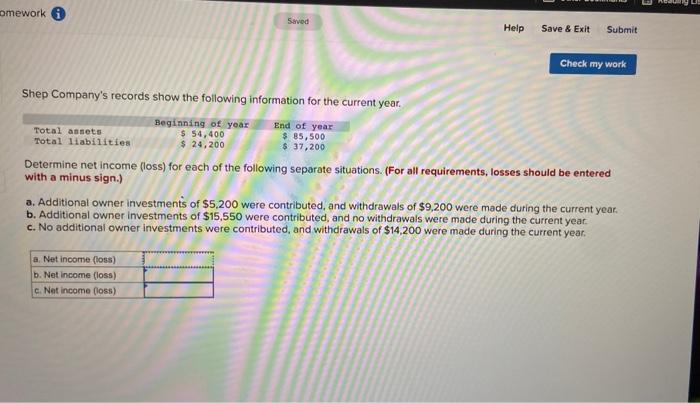

omework Saved Help Save & Exit Submit Check my work Shep Company's records show the following information for the current year. Beginning of year End of year Total assets $ 54,400 $ 85,500 Total liabilities $ 24, 200 $ 37,200 Determine net income (loss) for each of the following separate situations. (For all requirements, losses should be entered with a minus sign.) a. Additional owner investments of $5,200 were contributed, and withdrawals of $9,200 were made during the current year. b. Additional owner investments of $15,550 were contributed, and no withdrawals were made during the current year. c. No additional owner investments were contributed, and withdrawals of $14,200 were made during the current year. a Net income (loss) b. Net Income (loss) c. Nat income (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts