Question: o.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%... Z Professional Entertainment WSJ The Wall Street Jo. u Udemy Q Final Exam Flashc.. nework i Saved Help Save & Exit Subm Puello

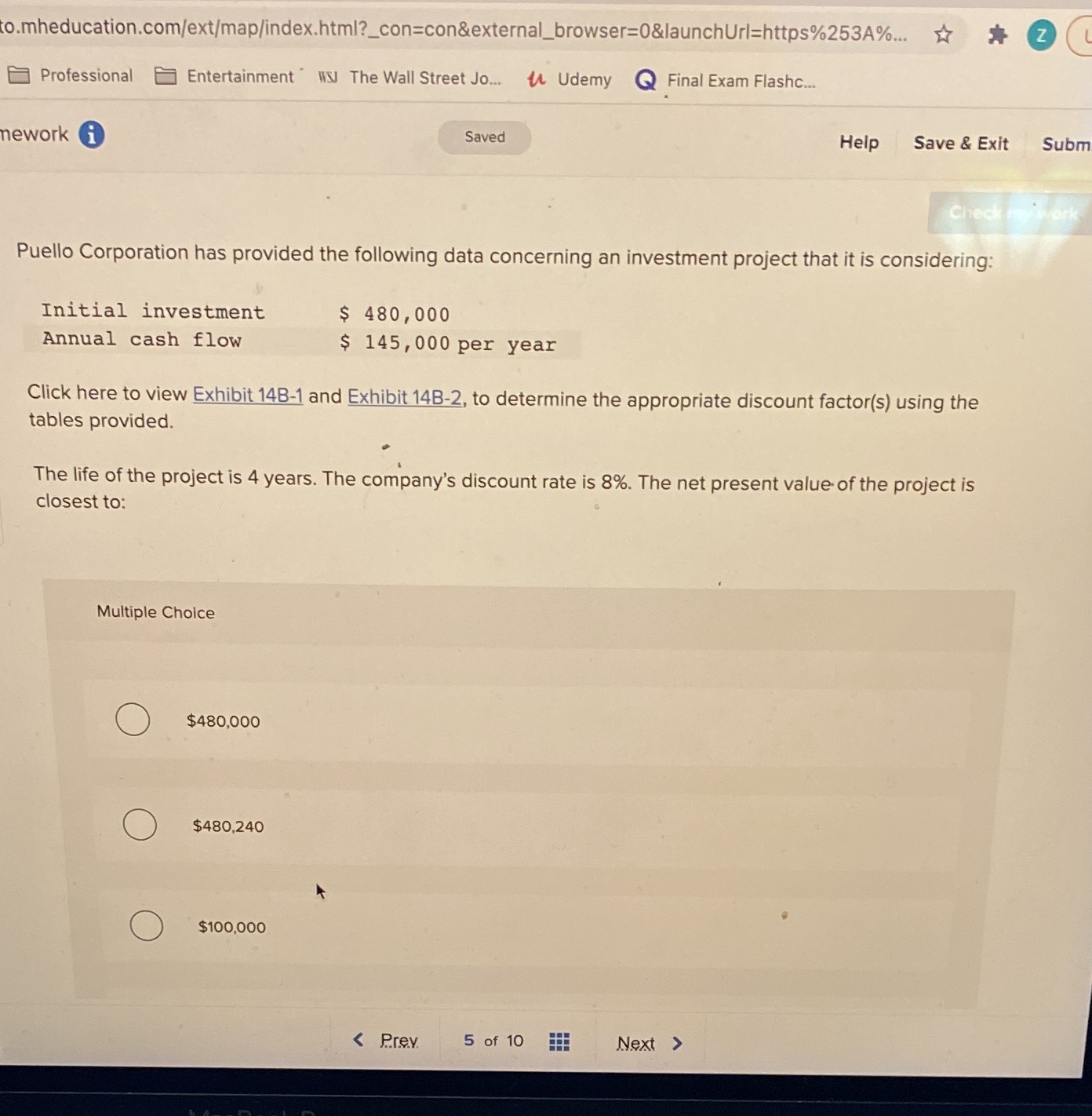

o.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%... Z Professional Entertainment " WSJ The Wall Street Jo. u Udemy Q Final Exam Flashc.. nework i Saved Help Save & Exit Subm Puello Corporation has provided the following data concerning an investment project that it is considering: Initial investment $ 480, 000 Annual cash flow $ 145, 000 per year Click here to view Exhibit 148-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using the tables provided. The life of the project is 4 years. The company's discount rate is 8%. The net present value of the project is closest to: Multiple Choice $480,000 $480,240 $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts