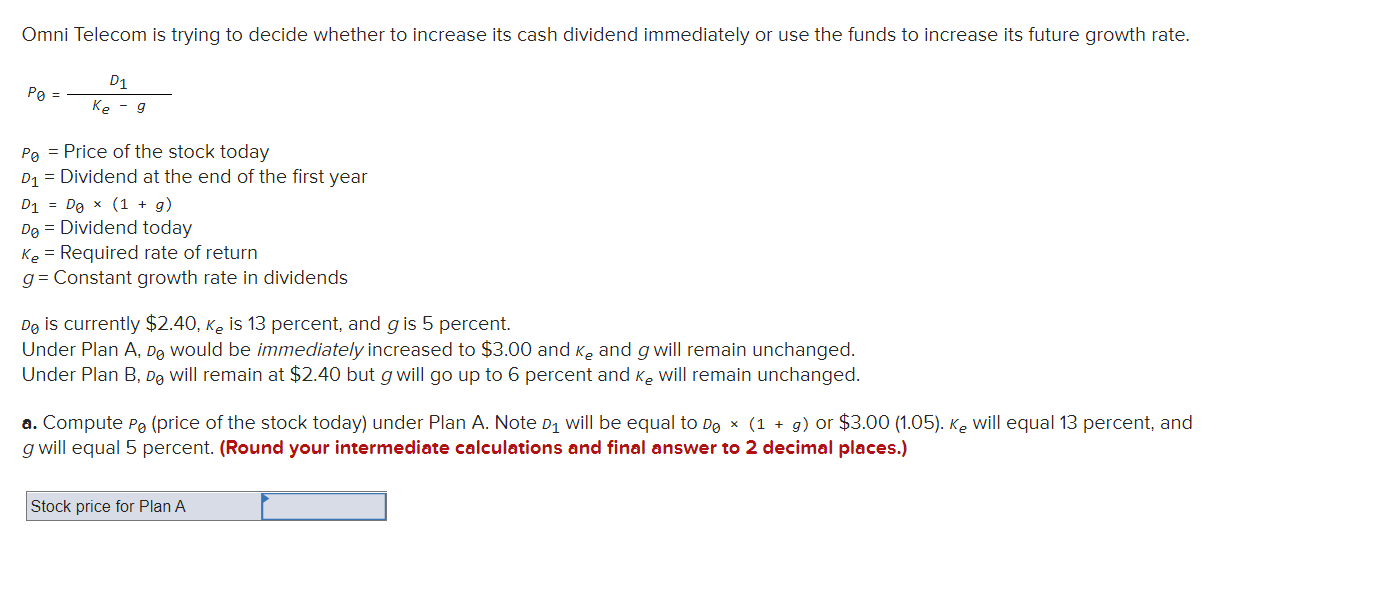

Question: Omni Telecom is trying to decide whether to increase its cash dividend immediately or use the funds to increase its future growth rate. P0=KegD1 P0=

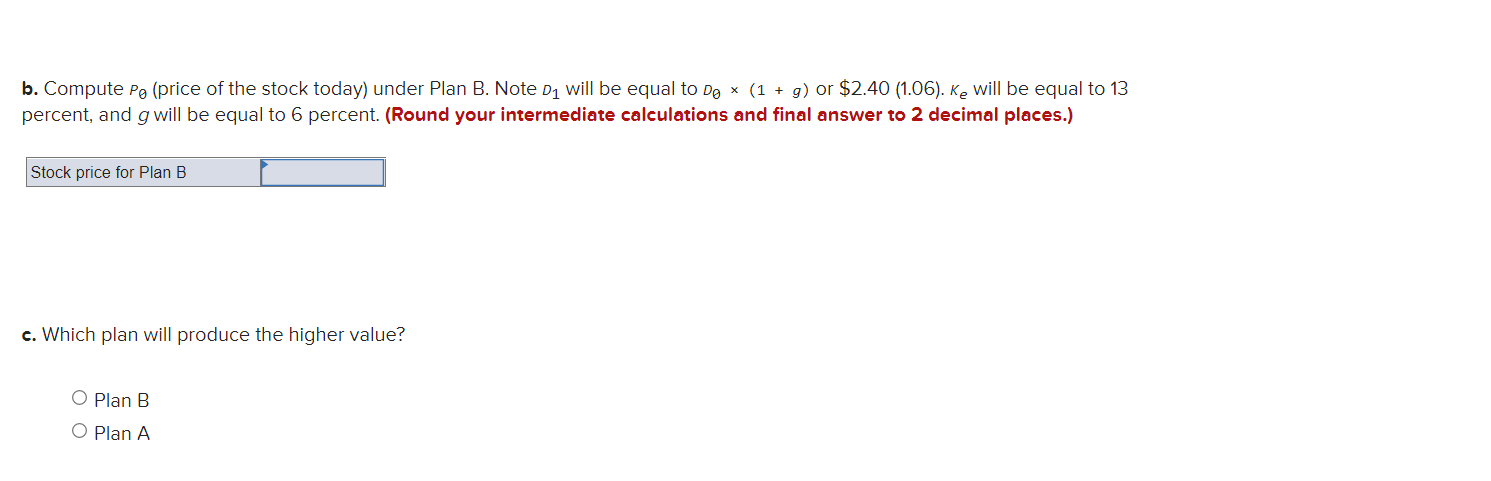

Omni Telecom is trying to decide whether to increase its cash dividend immediately or use the funds to increase its future growth rate. P0=KegD1 P0= Price of the stock today D1= Dividend at the end of the first year D1=D0(1+g) D0= Dividend today Ke= Required rate of return g= Constant growth rate in dividends D0 is currently $2.40,Ke is 13 percent, and g is 5 percent. Under Plan A,D0 would be immediately increased to $3.00 and e and g will remain unchanged. Under Plan B,D0 will remain at $2.40 but g will go up to 6 percent and e will remain unchanged. a. Compute P0 (price of the stock today) under Plan A. Note D1 will be equal to D0(1+g) or $3.00(1.05).Ke will equal 13 percent, and g will equal 5 percent. (Round your intermediate calculations and final answer to 2 decimal places.) b. Compute P (price of the stock today) under Plan B. Note D1 will be equal to D0(1+g) or $2.40(1.06). Ke will be equal to 13 percent, and g will be equal to 6 percent. (Round your intermediate calculations and final answer to 2 decimal places.) c. Which plan will produce the higher value? Plan B Plan A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts