Question: OMT310- Homework Ch 12 Help Save & E Submit Check my work 3 Exercise 12-SA Evaluate risk ratios (L012-3) points Spe The 2021 income statement

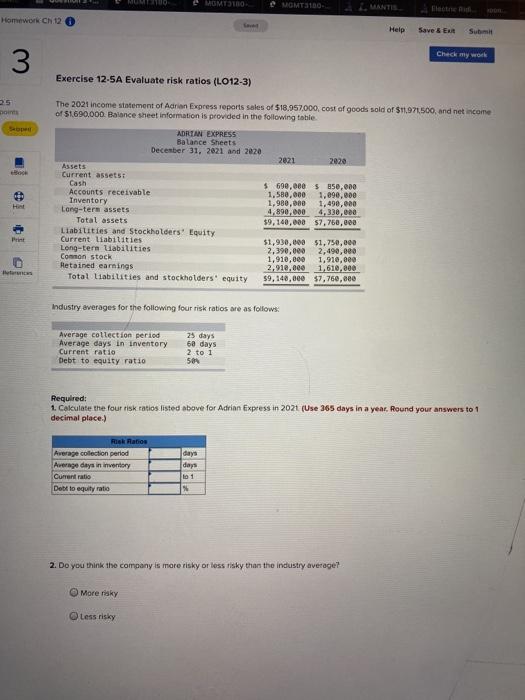

OMT310- Homework Ch 12 Help Save & E Submit Check my work 3 Exercise 12-SA Evaluate risk ratios (L012-3) points Spe The 2021 income statement of Adrian Express reports sales of $18.957,000, cost of goods sold of $11.971500, and net income of $1.690,000 Balance sheet information is provided in the following table ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets Cash $ 690,000 $350,000 Accounts receivable 1.580.000 1.090.000 Inventory 1.980,000 1,490,000 Long-term assets 4,890,000 4,330,000 Total assets $9, 140,000 $7,760,000 Liabilities and Stockholders' Equity Current liabilities $1,930,000 $1,750,000 Long-term Liabilities 2,390,000 2,490,000 Common stock 1,910,000 1,910,000 Retained earnings 2,912,000 1,610,000 Total liabilities and stockholders' equity $9,140,000 $7,760,000 Industry averages for the following four risk ratios are as follows: Average collection period Average days in inventory Current ratio Debt to equity ratio 25 days 60 days 2 to i 501 Required: 1. Cakulate the four risk ratios listed above for Adrian Express in 2021 (Use 365 days in a year. Round your answers to 1 decimal place.) Risk Ratio Average collection period Average days in invertory Current ratio Debt to equity ratio days days 2. Do you think the company is more risky or loss risky than the industry average More risky less risky

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts