Question: On 1 / 1 / 2 4 , P Corporation purchased 6 0 % of S Corporation for $ 9 0 0 , 0 0

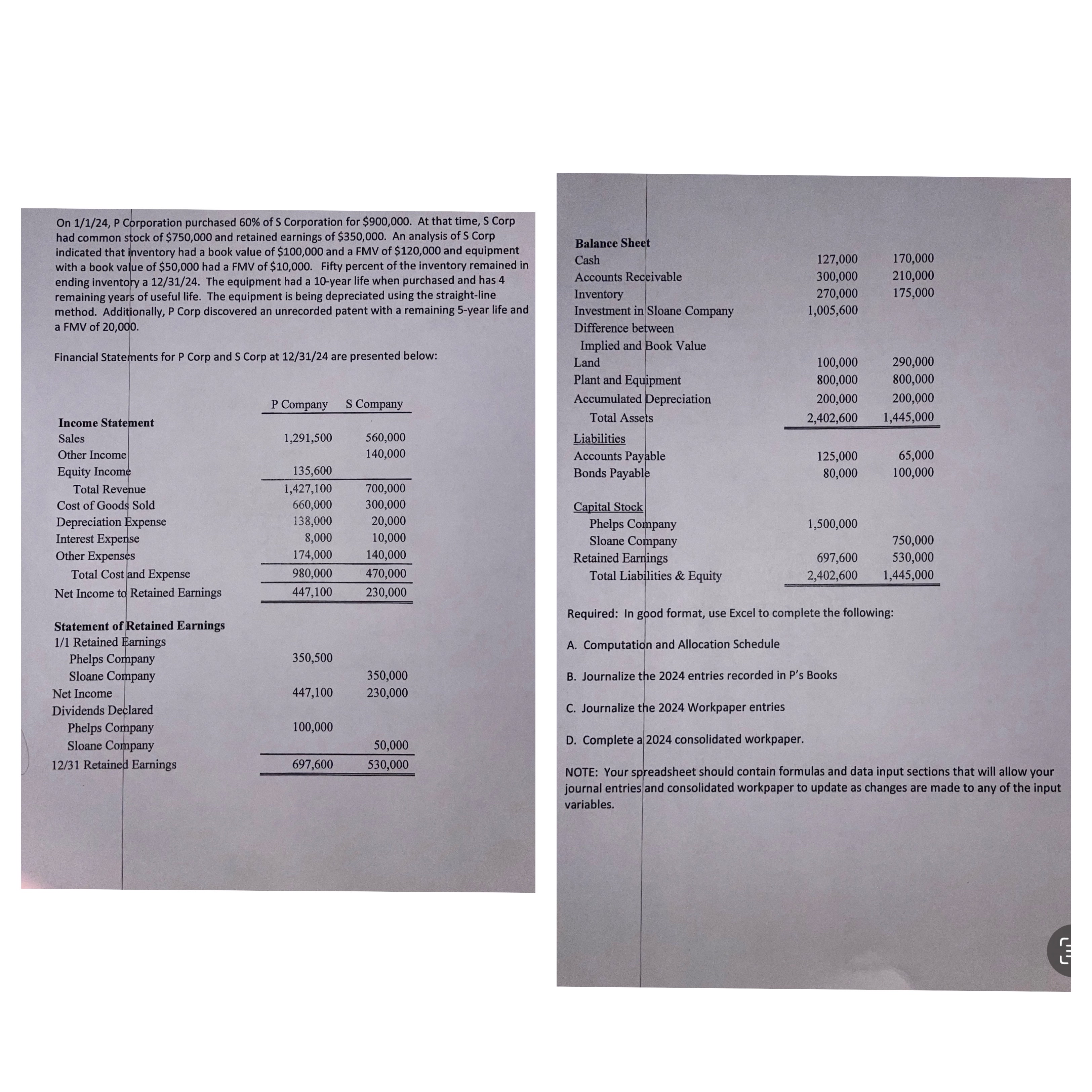

On P Corporation purchased of S Corporation for $ At that time, S Corp had common stock of $ and retained earnings of $ An analysis of S Corp indicated that inventory had a book value of $ and a FMV of $ and equipment with a book value of $ had a FMV of $ Fifty percent of the inventory remained in ending inventory a The equipment had a year life when purchased and has remaining years of useful life. The equipment is being depreciated using the straightline method. Additionally, P Corp discovered an unrecorded patent with a remaining year life and a FMV of Financial Statements for P Corp and S Corp at are presented below:P CompanyS CompanyIncome StatementSalesOther IncomeEquity IncomeTotal RevenueCost of Goods SoldDepreciation ExpenseInterest ExpenseOther ExpensesTotal Cost and ExpenseNet Income to Retained EarningsStatement of Retained Earnings Retained EarningsPhelps CompanySloane CompanyNet IncomeDividends DeclaredPhelps CompanySloane Company Retained EarningsBalance SheetCashAccounts ReceivableInventoryInvestment in Sloane CompanyDifference betweenImplied and Book ValueLandPlant and EquipmentAccumulated DepreciationTotal AssetsLiabilitiesAccounts PayableBonds PayableCapital StockPhelps CompanySloane CompanyRetained EarningsTotal Liabilities & EquityRequired: In good format, use Excel to complete the following:A Computation and Allocation ScheduleB. Journalize the entries recorded in Ps BooksC. Journalize the Workpaper entriesD. Complete a consolidated workpaper.NOTE: Your spreadsheet should contain formulas and data input sections that will allow your journal entries and consolidated workpaper to update as changes are made to any of the input variables.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock