Question: On 1 5 March 2 0 2 1 , Amanda Sharpe ( 6 0 years old ) created a trust for the benefit of her

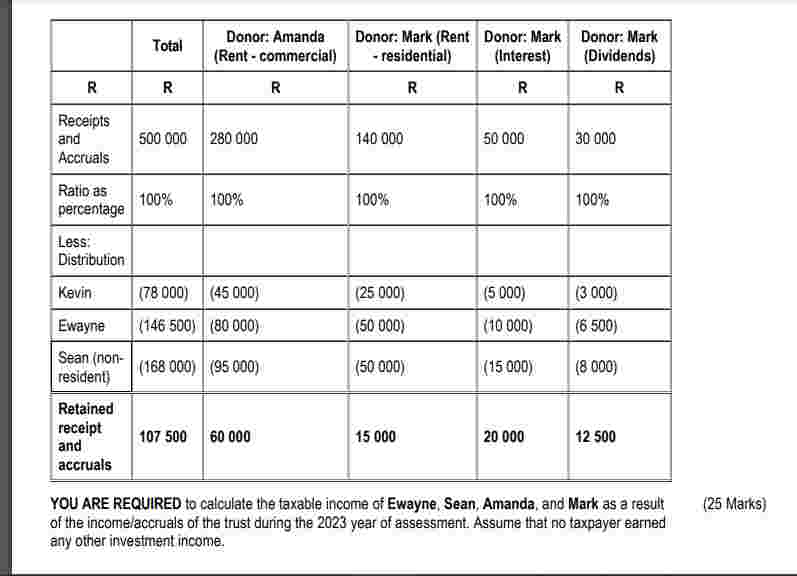

On March Amanda Sharpe years old created a trust for the benefit of her three children Kevin Ewayne, and Sean: Kevin is years old, unmarried and a resident of the Republic. Ewayne is years old, married and a resident of the Republic. Sean is years old and has been a nonresident of the Republic since July He visits the Republic once a year for a short period. Amanda donated a commercial building to the trust on March The trust earns rental income from this building. Mark years old resident, Amandas older brother, ceded the income from his residential flats to the trust until the trust dissolves. Mark also donated the following assets to the trust on March : A portfolio with shares in listed companies earning "local" dividends and A fixed deposit at a local bank earning interest. The trust deed contains the following provisions: Ewayne has a vested right to all the retained rentals from the commercial building. The trust will remain in existence until Kevin reaches the age of years. Upon this event, the income from the residential flats will revert back to Mark, and all other assets will be sold, with the proceeds equally divided among the surviving beneficiaries. Any distribution made by the trustees is to be allocated proportionally from all sources of income. The trust's income and expenditure for the year of assessment are as follows:

YOU ARE REQUIRED to calculate the taxable income of Ewayne, Sean, Amanda, and Mark as a result Marks of the incomelaccruals of the trust during the year of assessment. Assume that no taxpayer earned any other investment income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock