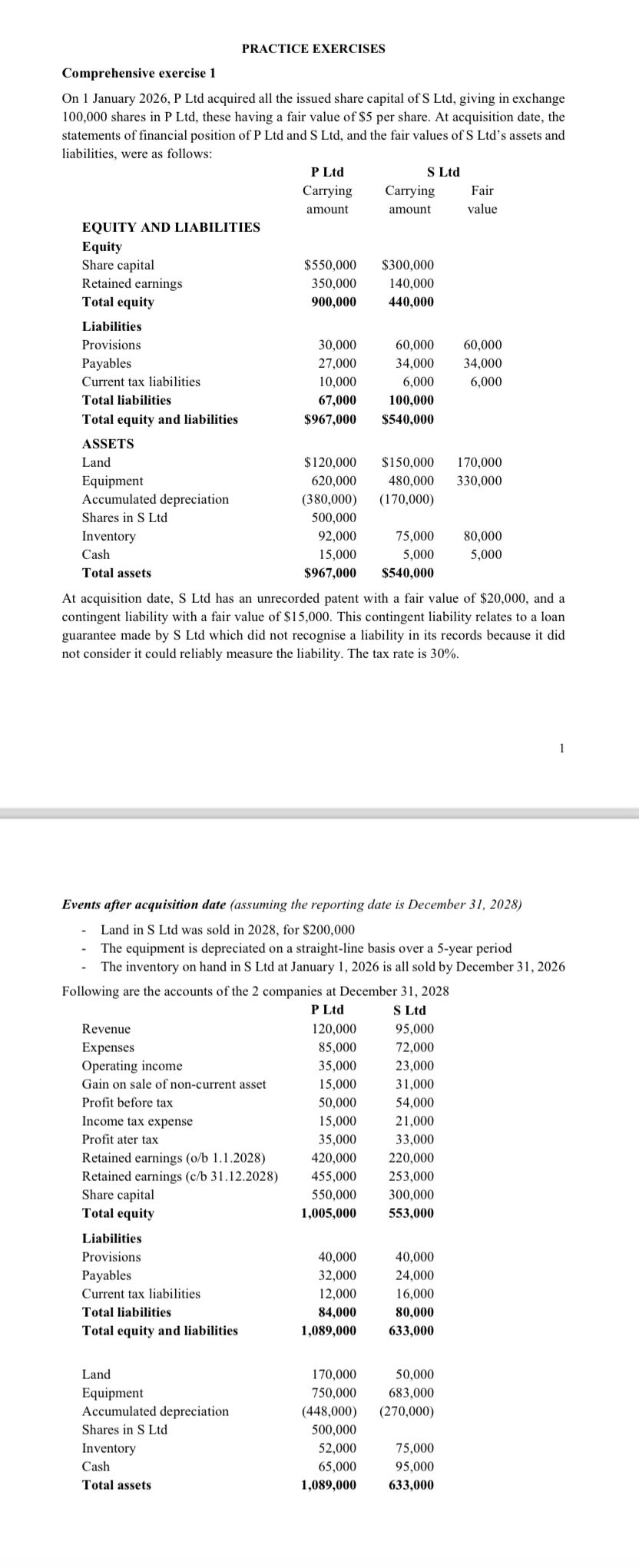

Question: On 1 January 2 0 2 6 , P Ltd acquired all the issued share capital of S Ltd , giving in exchange 1 0

On January P Ltd acquired all the issued share capital of S Ltd giving in exchange

shares in P Ltd these having a fair value of $ per share. At acquisition date, the

statements of financial position of P Ltd and S Ltd and the fair values of S Ltds assets and

liabilities, were as follows:

P Ltd S Ltd

Carrying

amount

Carrying

amount

Fair

value

EQUITY AND LIABILITIES

Equity

Share capital $ $

Retained earnings

Total equity

Liabilities

Provisions

Payables

Current tax liabilities

Total liabilities

Total equity and liabilities $ $

ASSETS

Land $ $

Equipment

Accumulated depreciation

Shares in S Ltd

Inventory

Cash

Total assets $ $

At acquisition date, S Ltd has an unrecorded patent with a fair value of $ and a

contingent liability with a fair value of $ This contingent liability relates to a loan

guarantee made by S Ltd which did not recognise a liability in its records because it did

not consider it could reliably measure the liability. The tax rate is

Events after acquisition date assuming the reporting date is December

Land in S Ltd was sold in for $

The equipment is depreciated on a straightline basis over a year period

The inventory on hand in S Ltd at January is all sold by December

Following are the accounts of the companies at December

P Ltd S Ltd

Revenue

Expenses

Operating income

Gain on sale of noncurrent asset

Profit before tax

Income tax expense

Profit ater tax

Retained earnings ob

Retained earnings cb

Share capital

Total equity

Liabilities

Provisions

Payables

Current tax liabilities

Total liabilities

Total equity and liabilities

Land

Equipment

Accumulated depreciation

Shares in S Ltd

Inventory

Cash

Total assets

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock