Question: On 1 July 2 0 1 9 , Biru Bhd acquired a patent for its new product at a cost of RM 2 , 0

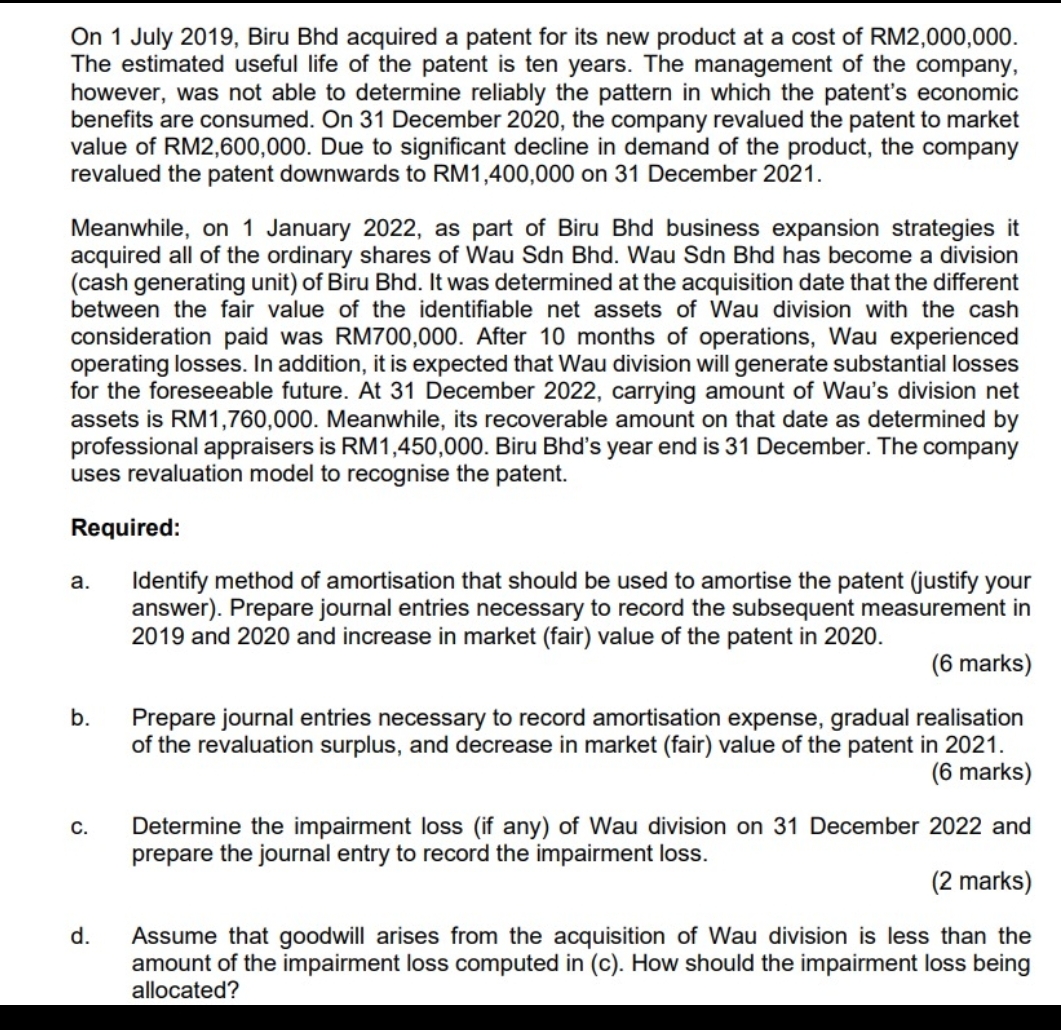

On July Biru Bhd acquired a patent for its new product at a cost of RM The estimated useful life of the patent is ten years. The management of the company, however, was not able to determine reliably the pattern in which the patent's economic benefits are consumed. On December the company revalued the patent to market value of RM Due to significant decline in demand of the product, the company revalued the patent downwards to RM on December

Meanwhile, on January as part of Biru Bhd business expansion strategies it acquired all of the ordinary shares of Wau Sdn Bhd Wau Sdn Bhd has become a division cash generating unit of Biru Bhd It was determined at the acquisition date that the different between the fair value of the identifiable net assets of Wau division with the cash consideration paid was RM After months of operations, Wau experienced operating losses. In addition, it is expected that Wau division will generate substantial losses for the foreseeable future. At December carrying amount of Wau's division net assets is RM Meanwhile, its recoverable amount on that date as determined by professional appraisers is RM Biru Bhds year end is December. The company uses revaluation model to recognise the patent.

Required:

a Identify method of amortisation that should be used to amortise the patent justify your answer Prepare journal entries necessary to record the subsequent measurement in and and increase in market fair value of the patent in

marks

b Prepare journal entries necessary to record amortisation expense, gradual realisation of the revaluation surplus, and decrease in market fair value of the patent in

marks

c Determine the impairment loss if any of Wau division on December and prepare the journal entry to record the impairment loss.

marks

d Assume that goodwill arises from the acquisition of Wau division is less than the amount of the impairment loss computed in c How should the impairment loss being allocated?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock