Question: On 1 July 2 0 2 0 , Simpson Ltd acquired 7 0 per cent of the share capital of Homer Ltd for (

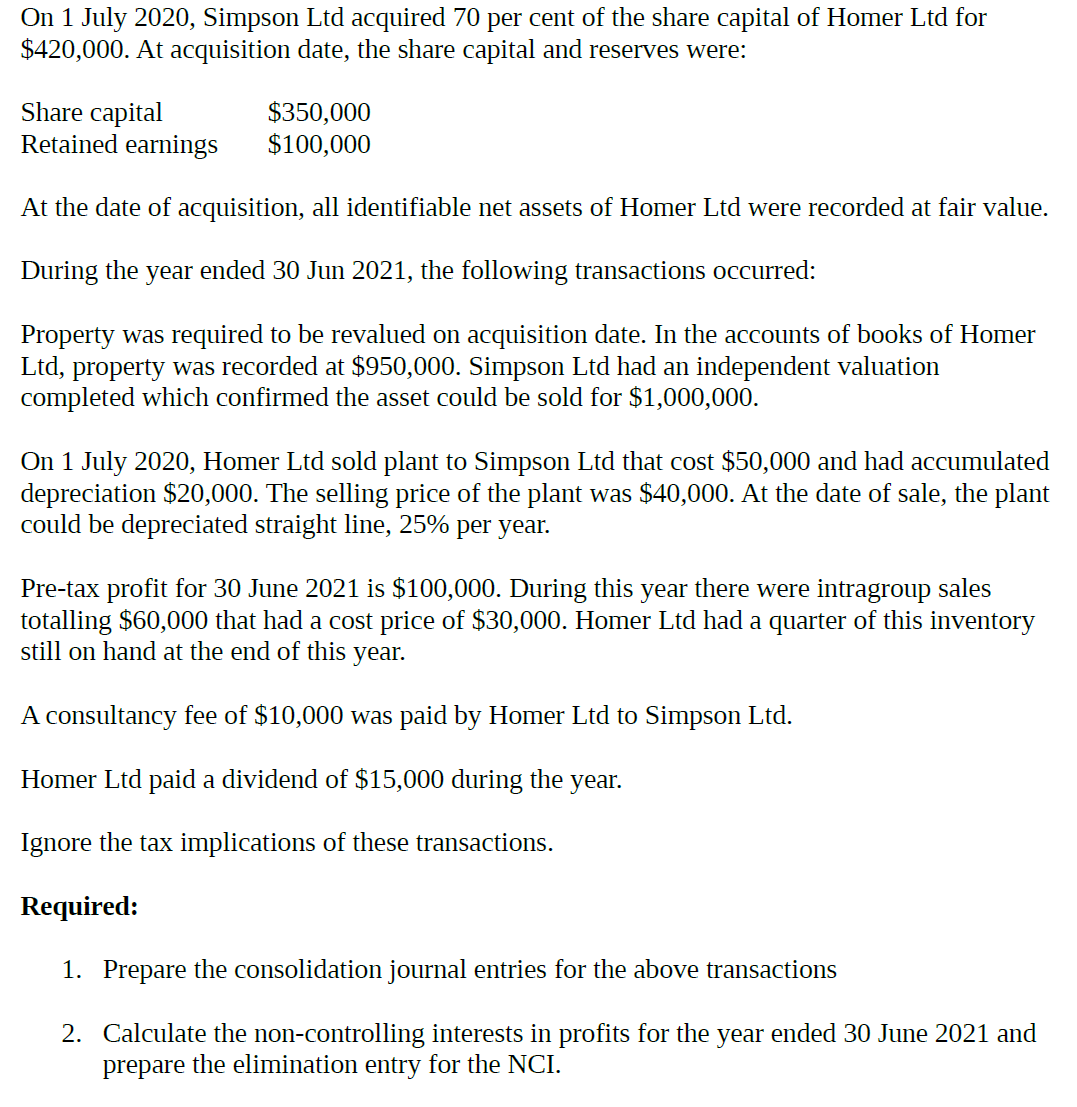

On July Simpson Ltd acquired per cent of the share capital of Homer Ltd for $ At acquisition date, the share capital and reserves were: At the date of acquisition, all identifiable net assets of Homer Ltd were recorded at fair value. During the year ended Jun the following transactions occurred: Property was required to be revalued on acquisition date. In the accounts of books of Homer Ltd property was recorded at $ Simpson Ltd had an independent valuation completed which confirmed the asset could be sold for $ On July Homer Ltd sold plant to Simpson Ltd that cost $ and had accumulated depreciation $ The selling price of the plant was $ At the date of sale, the plant could be depreciated straight line, per year. Pretax profit for June is $ During this year there were intragroup sales totalling $ that had a cost price of $ Homer Ltd had a quarter of this inventory still on hand at the end of this year. A consultancy fee of $ was paid by Homer Ltd to Simpson Ltd Homer Ltd paid a dividend of $ during the year. Ignore the tax implications of these transactions. Required: Prepare the consolidation journal entries for the above transactions Calculate the noncontrolling interests in profits for the year ended June and prepare the elimination entry for the NCI.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock