Question: On 1 July 2015, S acquired the issues shared (cum div.) of V for 120,000. At that date the financial statements of V included

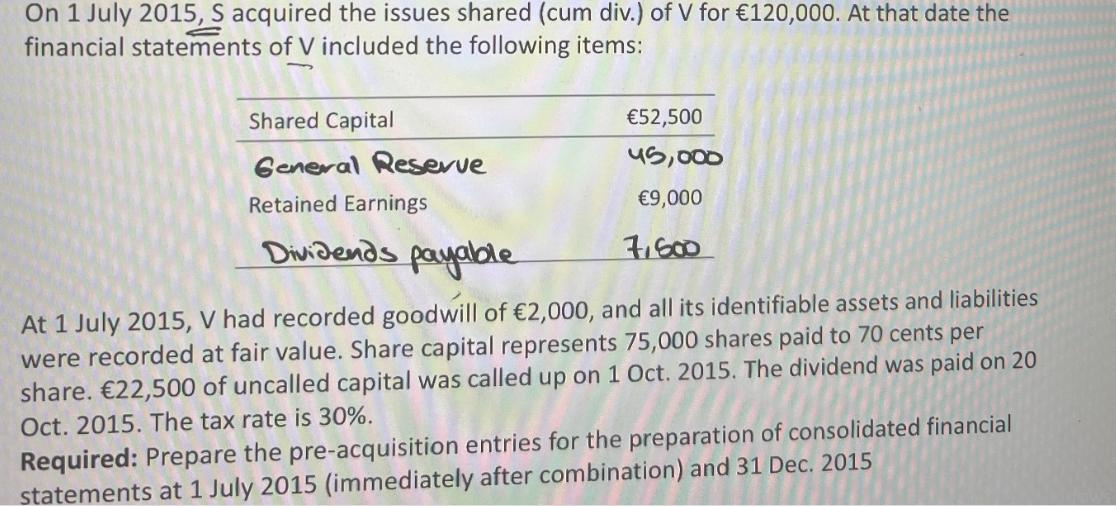

On 1 July 2015, S acquired the issues shared (cum div.) of V for 120,000. At that date the financial statements of V included the following items: Shared Capital General Reserve Retained Earnings Dividends payable At 1 July 2015, V had recorded goodwill of 2,000, and all its identifiable assets and liabilities were recorded at fair value. Share capital represents 75,000 shares paid to 70 cents per share. 22,500 of uncalled capital was called up on 1 Oct. 2015. The dividend was paid on 20 Oct. 2015. The tax rate is 30%. 52,500 45,000 9,000 7,600 Required: Prepare the pre-acquisition entries for the preparation of consolidated financial statements at 1 July 2015 (immediately after combination) and 31 Dec. 2015

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

SOLUTION Preacquisition entries at 1 July 2015 immediately after combination To eliminate the invest... View full answer

Get step-by-step solutions from verified subject matter experts