Question: On 1 October ( 2 0 times 5 ) Puma Bhd , a manufacturing company based in Nilai, NS , acquired a

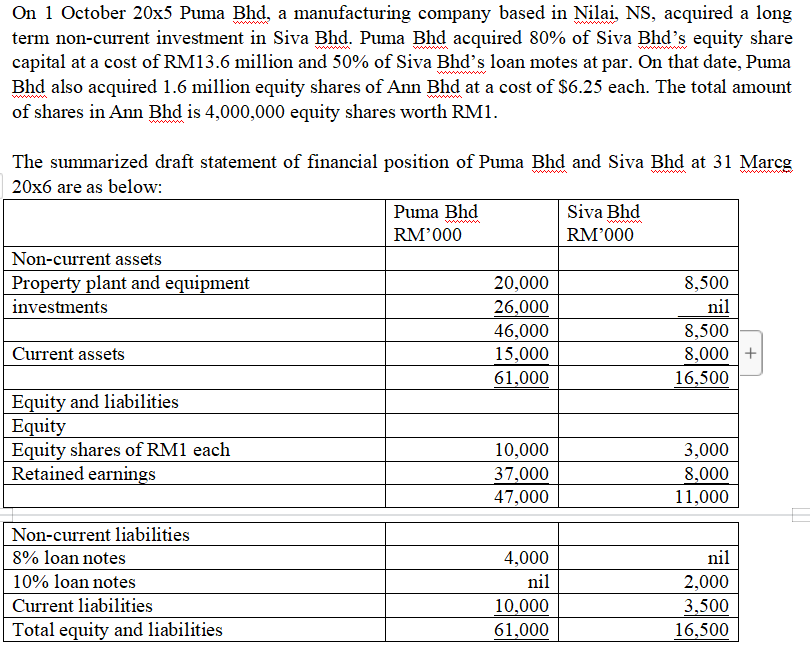

On October times Puma Bhd a manufacturing company based in Nilai, NS acquired a long term noncurrent investment in Siva Bhd Puma Bhd acquired of Siva Bhds equity share capital at a cost of RM million and of Siva Bhds loan motes at par. On that date, Puma Bhd also acquired million equity shares of Ann Bhd at a cost of $ each. The total amount of shares in Ann Bhd is equity shares worth RM The summarized draft statement of financial position of Puma Bhd and Siva Bhd at Marcg times are as below: begintabularlllhline & Puma Bhd RM & Siva Bhd RMhline Noncurrent assets & & hline Property plant and equipment & & hline investments & & nil hline & & hline Current assets & & hline & underlineunderline & hline Equity and liabilities & & hline Equity & & hline Equity shares of RM each & & hline Retained earnings & & hline & & hline endtabularbegintabularlllhline Noncurrent liabilities & & hline loan notes & & nil hline loan notes & nil & hline Current liabilities & & hline Total equity and liabilities & & hline endtabular The following information is relevant:

i The fair value of Siva Bhds assets were equal to their carrying amounts with the exception of land and plant. Siva Bhds land had a fair value of RM in excess of its carrying amount and plant had a fair value of RM million in excess of its carrying amount. The plant had a remaining life of four years straightline depreciation at the date of acquisition.

ii In the post acquisition period Puma Bhd sold goods to Siva Bhd at a price of RM million. These goods had cost Puma Bhd RM million. Half of these goods were still in the inventory of Siva Bhd at March x Siva Bhd had a balance of RM million owing to Puma Bhd at March x which agreed with Puma Bhds records.

iii The net profit after tax for the year ended March x was RM million for Siva Bhds and RM million for Ann Bhd Assume profits accrued evenly throughout the year.

iv An impairment test at March times concluded that consolidated goodwill was impaired by RM and the investment in Ann Bhd was impaired by RM

v No dividends were paid during the year by any of the companies.

vi It is group policy to value noncontrolling interest at acquisition at full or fair value. The directors valued the noncontrolling interest at acquisition at RM million.

Required:

a Discuss how investments purchased by Puma Bhd on October times should be treated in its consolidated statements.

marks

b Prepare the consolidated statements of financial position for Puma Bhd as at March x

marks

Total marks

Show all your workings clearly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock