Question: On 1/1/X1, Wolfpack Inc. issues 3-year bonds with a face value of $50,000 and a face (stated) rate of 4% compounded semi-annually. The market interest

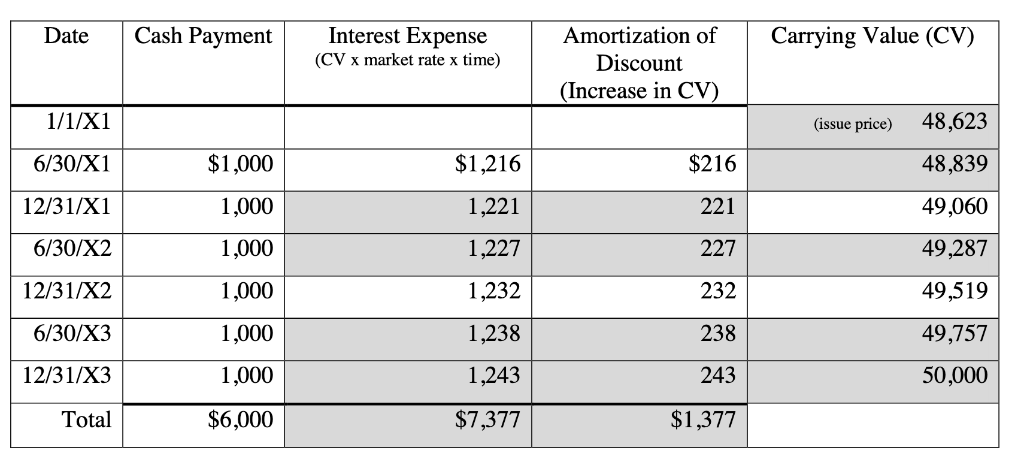

On 1/1/X1, Wolfpack Inc. issues 3-year bonds with a face value of $50,000 and a face (stated) rate of 4% compounded semi-annually. The market interest rate for bonds of similar risk and maturity is 5% compounded semi-annually. Interest is paid semi-annually on June 30 and December 31 beginning on June 30, 20X1. The bonds mature on 12/31/X3.

This chart is correct, but I'm wondering exactly how the interest expenses were calculated? I see the formula listed, but what numbers are used? How do we know what to plug in?

DateC Cash Payment Interest Expense (CV x market rate x time) Amortization of Carrying Value (CV) Discount (Increase in CV) 1/1/X1 6/30/X1 12/31/X1 6/30/X2 12/31/X2 6/30/X3 12/31/X.3 Total $1,000 1,000 1,000 1,000 1,000 1,000 $6,000 $1,216 1,221 1,227 1,232 1,238 1,243 $7,377 $216 221 227 232 238 243 $1,377 (issue price) 48,623 48,839 49,060 49,287 49,519 49,757 50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts