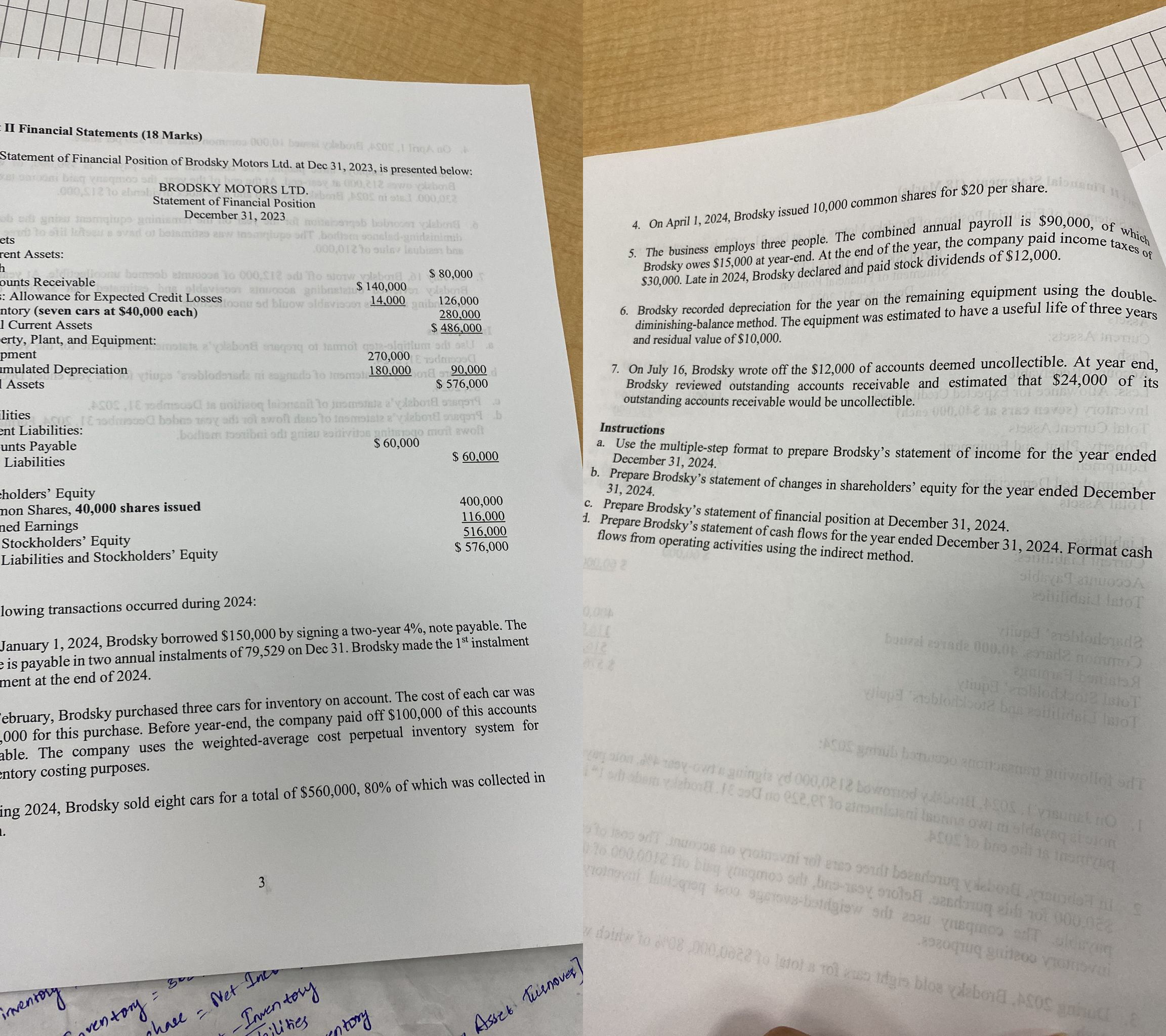

Question: On April 1 , 2 0 2 4 , Brodsky issued 1 0 , 0 0 0 common shares for $ 2 0 per share.

On April Brodsky issued common shares for $ per share.

The business employs three people. The combined annual payroll is $ of which

Brodsky owes $ at yearend. At the end of the year, the company paid income taxes of

$ Late in Brodsky declared and paid stock dividends of $

Brodsky recorded depreciation for the year on the remaining equipment using the double

diminishingbalance method. The equipment was estimated to have a useful life of three years

and residual value of $

On July Brodsky wrote off the $ of accounts deemed uncollectible. At year end,

Brodsky reviewed outstanding accounts receivable and estimated that $ of its

outstanding accounts receivable would be uncollectible.

Instructions

a Use the multiplestep format to prepare Brodsky's statement of income for the year ended

December

b Prepare Brodsky's statement of changes in shareholders' equity for the year ended December

c Prepare Brodsky's statement of financial position at December

Prepare Brodsky's statement of cash flows for the year ended December Format cash

flows from operating activities using the indirect method.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock