Question: On April 1, 2014, Able Co borrows $200,000 for four years from the Toy Company to obtain funds to buy a piece of commercial property.

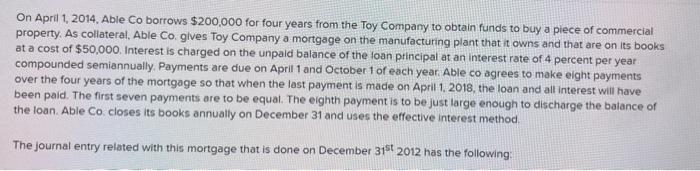

On April 1, 2014, Able Co borrows $200,000 for four years from the Toy Company to obtain funds to buy a piece of commercial property. As collateral, Able Co. gives Toy Company a mortgage on the manufacturing plant that it owns and that are on its books at a cost of $50,000. Interest is charged on the unpald balance of the foan principal at an interest rate of 4 percent per year compounded semiannually. Payments are due on April 1 and October 1 of each year. Able co agrees to make eight payments over the four years of the mortgage so that when the last payment is made on April 1. 2018, the loan and all interest will have been paid. The first seven payments are to be equal. The eighth payment is to be just large enough to discharge the balance of the loan. Able Co. closes its books annually on December 31 and uses the effective interest method. The journal entry related with this mortgage that is done on December 31st2012 has the following: Mortgage Payable credited Interest Expense credited None of the other alternatives are correct Interest Payable credited Cash credited

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts