Question: On April 1 , Time Co . is considering three scenarios that accelerate the collection of outstanding accounts receivable totaling $ 2 4 0 ,

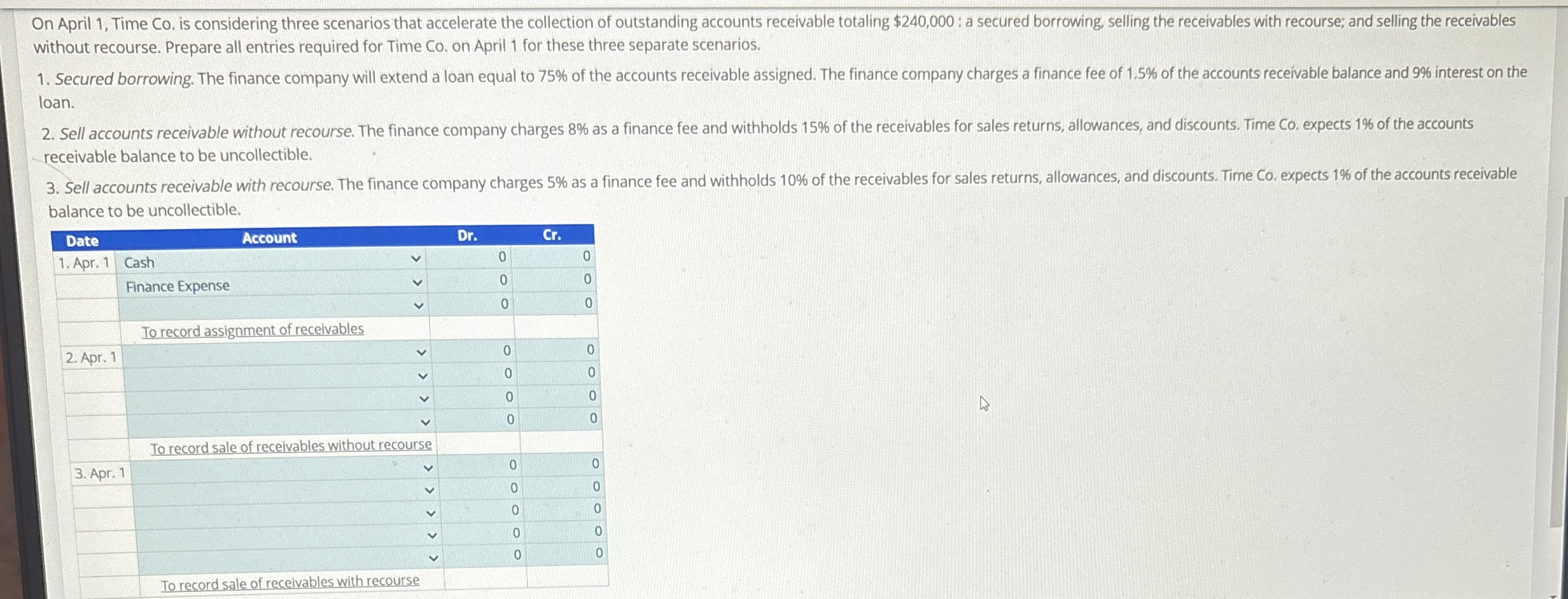

On April Time Co is considering three scenarios that accelerate the collection of outstanding accounts receivable totaling $ : a secured borrowing, selling the receivables with recourse; and selling the receivables without recourse. Prepare all entries required for Time Co on April for these three separate scenarios.

Secured borrowing. The finance company will extend a loan equal to of the accounts receivable assigned. The finance company charges a finance fee of of the accounts receivable balance and interest on the loan.

Sell accounts receivable without recourse. The finance company charges as a finance fee and withholds of the receivables for sales returns, allowances, and discounts. Time Co expects of the accounts receivable balance to be uncollectible.

Sell accounts receivable with recourse. The finance company charges as a finance fee and withholds of the receivables for sales returns, allowances, and discounts. Time Co expects of the accounts receivable balance to be uncollectible.

tableDateAccount,DrCr Apr. Cash vFinance Expense To record assignment of receivables,, Apr. To record sale of receivables without recourse,, Apr. To record sale of receivables with recourse,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock