Question: On April 25, 2012, Coca-Cola announced its first stock split in 16 years and only its eleventh stock split since the stock began trading

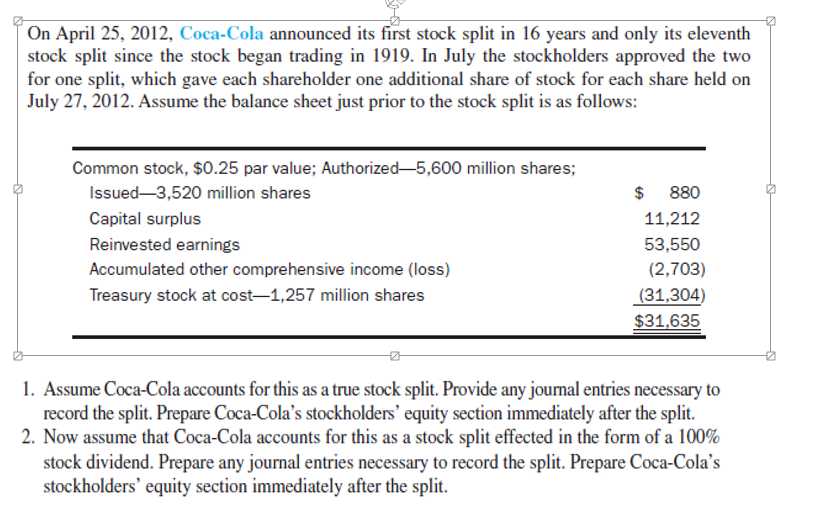

On April 25, 2012, Coca-Cola announced its first stock split in 16 years and only its eleventh stock split since the stock began trading in 1919. In July the stockholders approved the two for one split, which gave each shareholder one additional share of stock for each share held on July 27, 2012. Assume the balance sheet just prior to the stock split is as follows: Common stock, $0.25 par value; Authorized-5,600 million shares; Issued-3,520 million shares Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock at cost-1,257 million shares $ 880 11,212 53,550 (2,703) (31,304) $31,635 1. Assume Coca-Cola accounts for this as a true stock split. Provide any journal entries necessary to record the split. Prepare Coca-Cola's stockholders' equity section immediately after the split. 2. Now assume that Coca-Cola accounts for this as a stock split effected in the form of a 100% stock dividend. Prepare any journal entries necessary to record the split. Prepare Coca-Cola's stockholders' equity section immediately after the split.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts