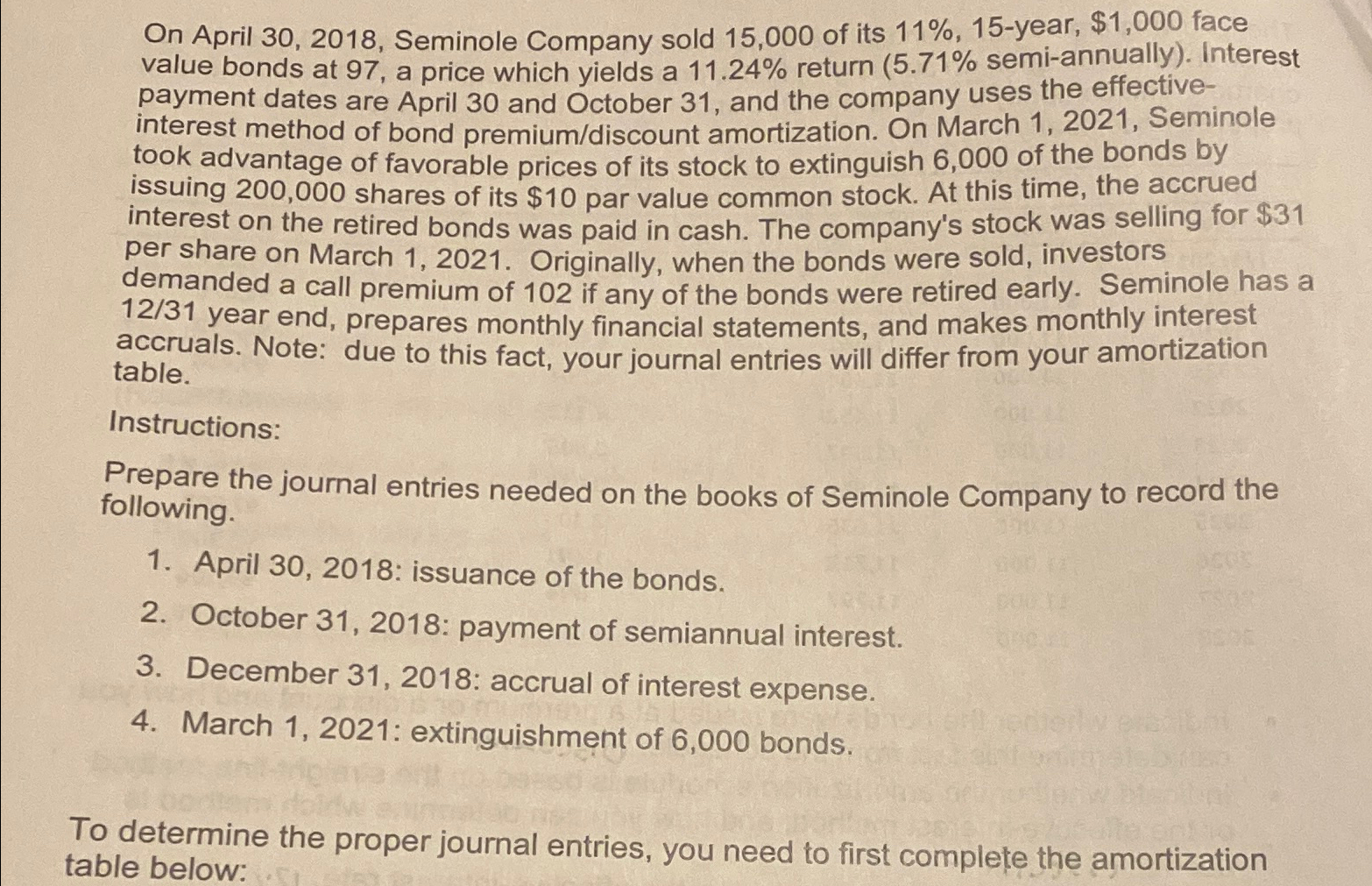

On April Seminole Company sold of its year, $ face value bonds at a price which yields a return semiannually Interest payment dates are April and October and the company uses the effectiveinterest method of bond premiumdiscount amortization. On March Seminole took advantage of favorable prices of its stock to extinguish of the bonds by issuing shares of its $ par value common stock. At this time, the accrued interest on the retired bonds was paid in cash. The company's stock was selling for $ per share on March Originally, when the bonds were sold, investors demanded a call premium of if any of the bonds were retired early. Seminole has a year end, prepares monthly financial statements, and makes monthly interest accruals. Note: due to this fact, your journal entries will differ from your amortization table.

Instructions:

Prepare the journal entries needed on the books of Seminole Company to record the following.

April : issuance of the bonds.

October : payment of semiannual interest.

December : accrual of interest expense.

March : extinguishment of bonds.

To determine the proper journal entries, you need to first complete the amortization table below: