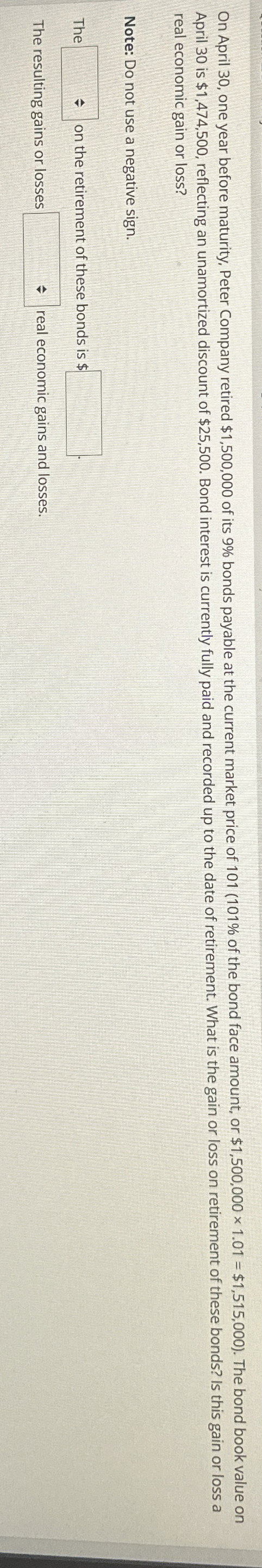

Question: On April 3 0 , one year before maturity, Peter Company retired $ 1 , 5 0 0 , 0 0 0 of its 9

On April one year before maturity, Peter Company retired $ of its bonds payable at the current market price of of the bond face amount, or $$ The bond book value on April is $ reflecting an unamortized discount of $ Bond interest is currently fully paid and recorded up to the date of retirement. What is the gain or loss on retirement of these bonds? Is this gain or loss a real economic gain or loss?

Note: Do not use a negative sign.

The on the retirement of these bonds is $

The resulting gains or losses real economic gains and losses.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock