Question: On August 1, 2023, Shark loaned $ 20,000.00 to Needs A Break Corp. The terms are Six-month note due January 30, 2024 Interest Rate

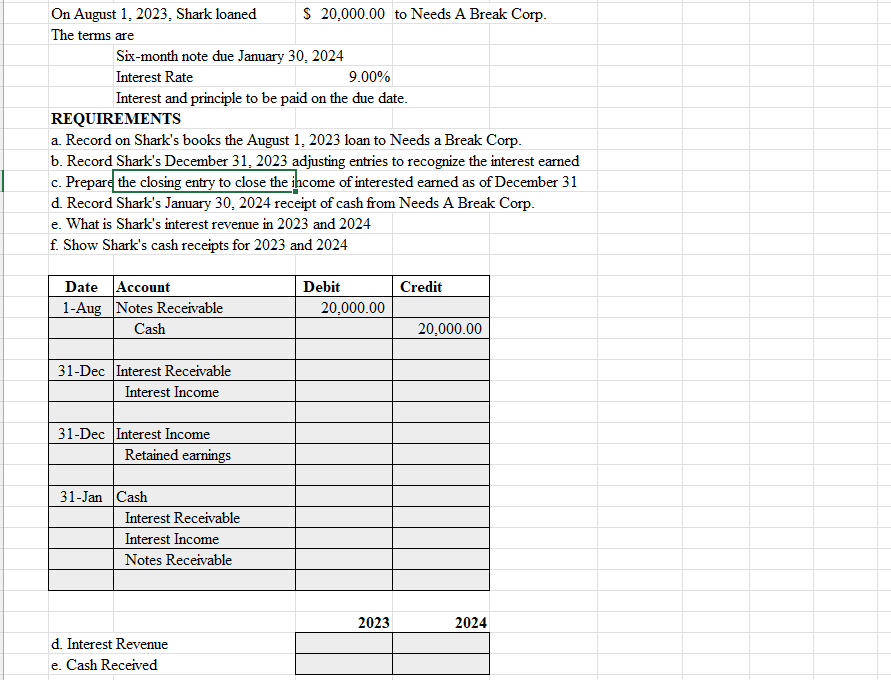

On August 1, 2023, Shark loaned $ 20,000.00 to Needs A Break Corp. The terms are Six-month note due January 30, 2024 Interest Rate 9.00% Interest and principle to be paid on the due date. REQUIREMENTS a. Record on Shark's books the August 1, 2023 loan to Needs a Break Corp. b. Record Shark's December 31, 2023 adjusting entries to recognize the interest earned c. Prepare the closing entry to close the income of interested earned as of December 31 d. Record Shark's January 30, 2024 receipt of cash from Needs A Break Corp. e. What is Shark's interest revenue in 2023 and 2024 f. Show Shark's cash receipts for 2023 and 2024 Date Account 1-Aug Notes Receivable Cash 31-Dec Interest Receivable Interest Income 31-Dec Interest Income Retained earnings 31-Jan Cash Debit 20,000.00 Credit 20,000.00 Interest Receivable Interest Income Notes Receivable d. Interest Revenue e. Cash Received 2023 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts