Question: On August 1 , Year 1 , SuperCool Software ( SCS ) began developing a software program to allow individuals to customize their investment portfolios.

On August Year SuperCool Software SCS began developing a software program to allow individuals to customize their investment portfolios. Technological feasibility was established on January st of year and the program was available for release on March year Development costs were incurred as follows:

August through December Year $ January through January Year February through March Year

SCS expects a useful life of five years for the software and total revenues of $ during that time. During Year SCS recognized $ in revenue, included in the $ total revenue estimate.

Calculate the required amortization for Year Hint: calculate using both methods, choose the greater number

Required information

The following information applies to the questions displayed below.

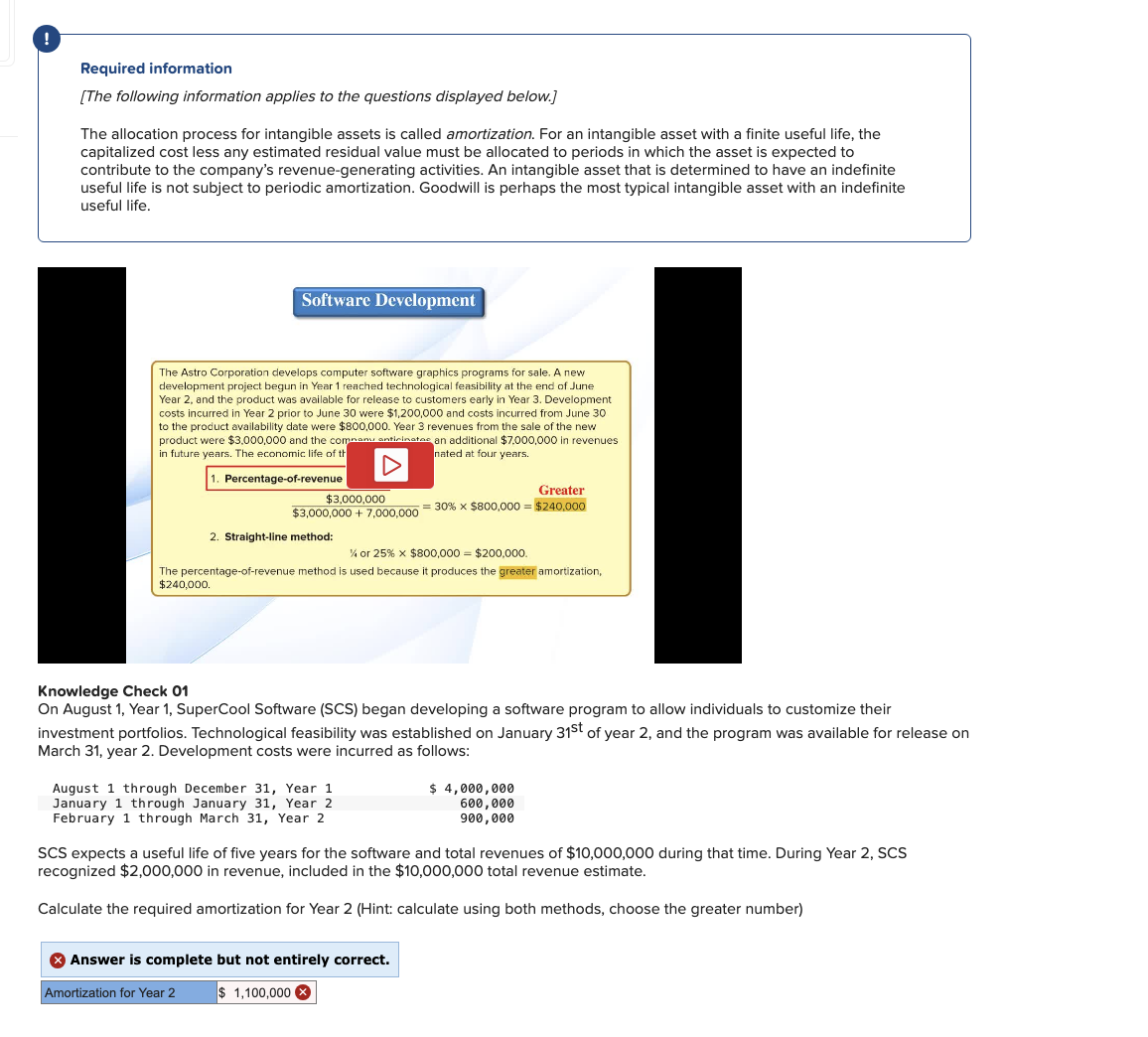

The allocation process for intangible assets is called amortization. For an intangible asset with a finite useful life, the capitalized cost less any estimated residual value must be allocated to periods in which the asset is expected to contribute to the company's revenuegenerating activities. An intangible asset that is determined to have an indefinite useful life is not subject to periodic amortization. Goodwill is perhaps the most typical intangible asset with an indefinite useful life.

The Astro Corporation develops computer software graphics programs for sale. A new development project begun in Year reached technological feasibility at the end of June Year and the product was available for release to customers early in Year Development costs incurred in Year prior to June were $ and costs incurred from June to the product availability date were $ Year revenues from the sale of the new product were $ and the comnanu antiminatac an additional $ in revenues in future years. The economic life of t nated at four years.

The percentageofrevenue method is used because it produces the greater amortization, $

Knowledge Check

On August Year SuperCool Software SCS began developing a software program to allow individuals to customize their investment portfolios. Technological feasibility was established on January text st of year and the program was available for release on March year Development costs were incurred as follows:

August through December Year

$

SCS expects a useful life of five years for the software and total revenues of $ during that time. During Year SCS recognized $ in revenue, included in the $ total revenue estimate.

Calculate the required amortization for Year Hint: calculate using both methods, choose the greater number

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock