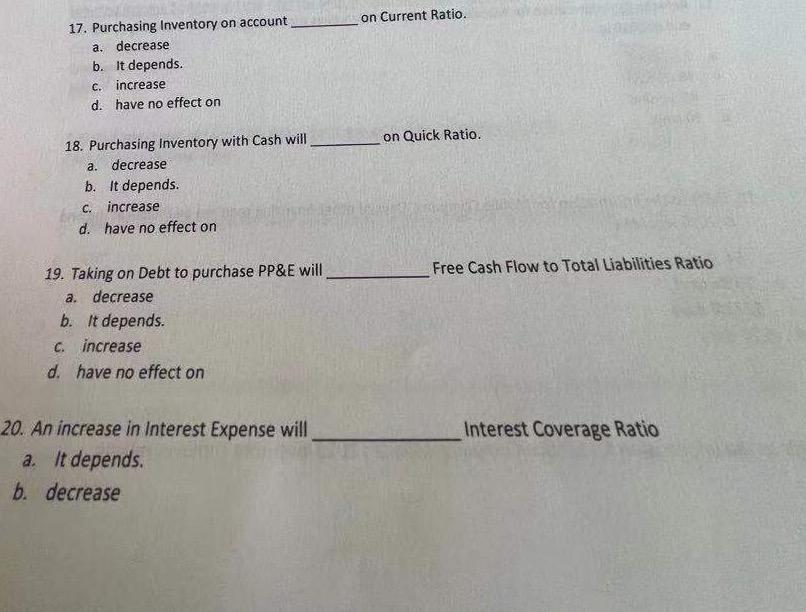

Question: on Current Ratio. 17. Purchasing Inventory on account a. decrease b. It depends. C. increase d. have no effect on on Quick Ratio. 18. Purchasing

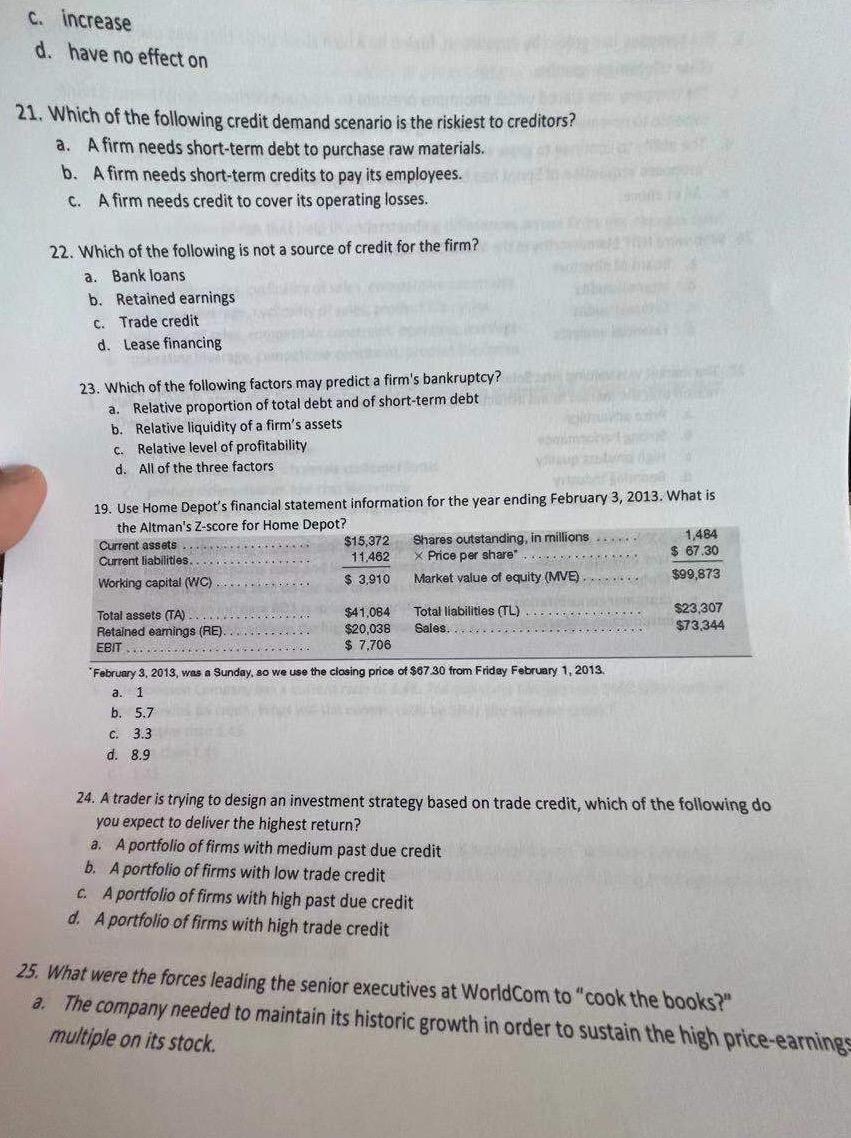

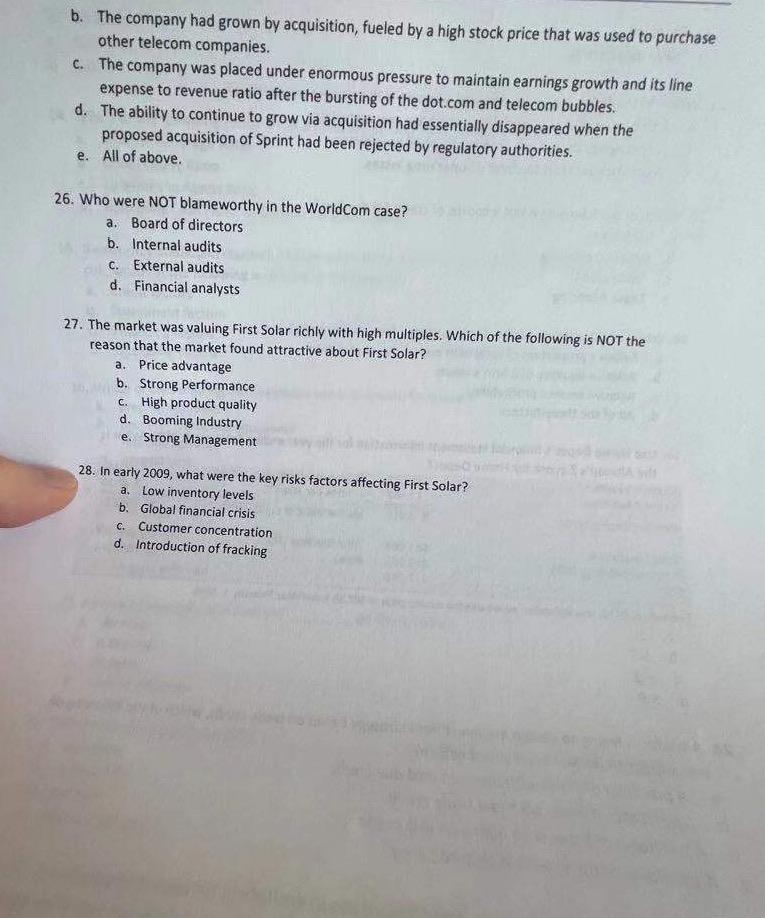

on Current Ratio. 17. Purchasing Inventory on account a. decrease b. It depends. C. increase d. have no effect on on Quick Ratio. 18. Purchasing Inventory with Cash will a. decrease b. It depends. c. increase d. have no effect on Free Cash Flow to Total Liabilities Ratio 19. Taking on Debt to purchase PP&E will a. decrease b. It depends. c. increase d. have no effect on Interest Coverage Ratio 20. An increase in Interest Expense will a. It depends. b. decrease C. increase d. have no effect on 21. Which of the following credit demand scenario is the riskiest to creditors? a. A firm needs short-term debt to purchase raw materials. b. A firm needs short-term credits to pay its employees. C. Afirm needs credit to cover its operating losses. 22. Which of the following is not a source of credit for the firm? a. Bank loans b. Retained earnings c. Trade credit d. Lease financing 23. Which of the following factors may predict a firm's bankruptcy? a. Relative proportion of total debt and of short-term debt b. Relative liquidity of a firm's assets C. Relative level of profitability d. All of the three factors w 19. Use Home Depot's financial statement information for the year ending February 3, 2013. What is the Altman's Z-score for Home Depot? Current assets ........... $15,372 Shares outstanding, in millions ...... 1,484 Current liabilities 11,462 X Price per share $ 67.30 Working capital (WC) $ 3.910 Market value of equity (MVE)...... $99,873 .. . $23,307 $73,344 Total assets (TA) ................. $41,084 Total liabilities (TL) Retained earings (RE). $20,038 Sales.... EBIT ....... $ 7.706 February 3, 2013, was a Sunday, so we use the closing price of $67.30 from Friday February 1, 2013 a. 1 b. 5.7 C. 3.3 d. 8.9 24. A trader is trying to design an investment strategy based on trade credit, which of the following do you expect to deliver the highest return? a. A portfolio of firms with medium past due credit b. A portfolio of firms with low trade credit c. A portfolio of firms with high past due credit d. A portfolio of firms with high trade credit 25. What were the forces leading the senior executives at World Com to "cook the books?" a. The company needed to maintain its historic growth in order to sustain the high price-earnings multiple on its stock. b. The company had grown by acquisition, fueled by a high stock price that was used to purchase other telecom companies. c. The company was placed under enormous pressure to maintain earnings growth and its line expense to revenue ratio after the bursting of the dot.com and telecom bubbles. d. The ability to continue to grow via acquisition had essentially disappeared when the proposed acquisition of Sprint had been rejected by regulatory authorities. e. All of above. 26. Who were NOT blameworthy in the World Com case? a. Board of directors b. Internal audits c. External audits d. Financial analysts 27. The market was valuing First Solar richly with high multiples. Which of the following is NOT the reason that the market found attractive about First Solar? a. Price advantage b. Strong Performance C. High product quality d. Booming Industry e. Strong Management 28. In early 2009, what were the key risks factors affecting First Solar? a. Low inventory levels b. Global financial crisis C. Customer concentration d. Introduction of fracking

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts