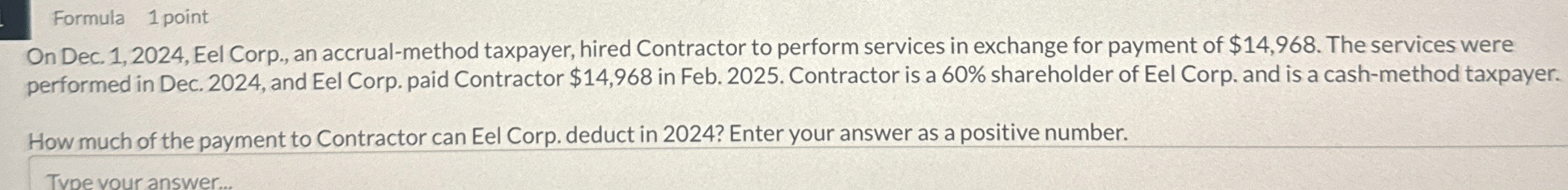

Question: On Dec. 1 , 2 0 2 4 , Eel Corp., an accrual - method taxpayer, hired Contractor to perform services in exchange for payment

Step by Step Solution

There are 3 Steps involved in it

To determine how much of the payment Eel Corp can deduct in 2024 we need to consider the rules ... View full answer

Get step-by-step solutions from verified subject matter experts