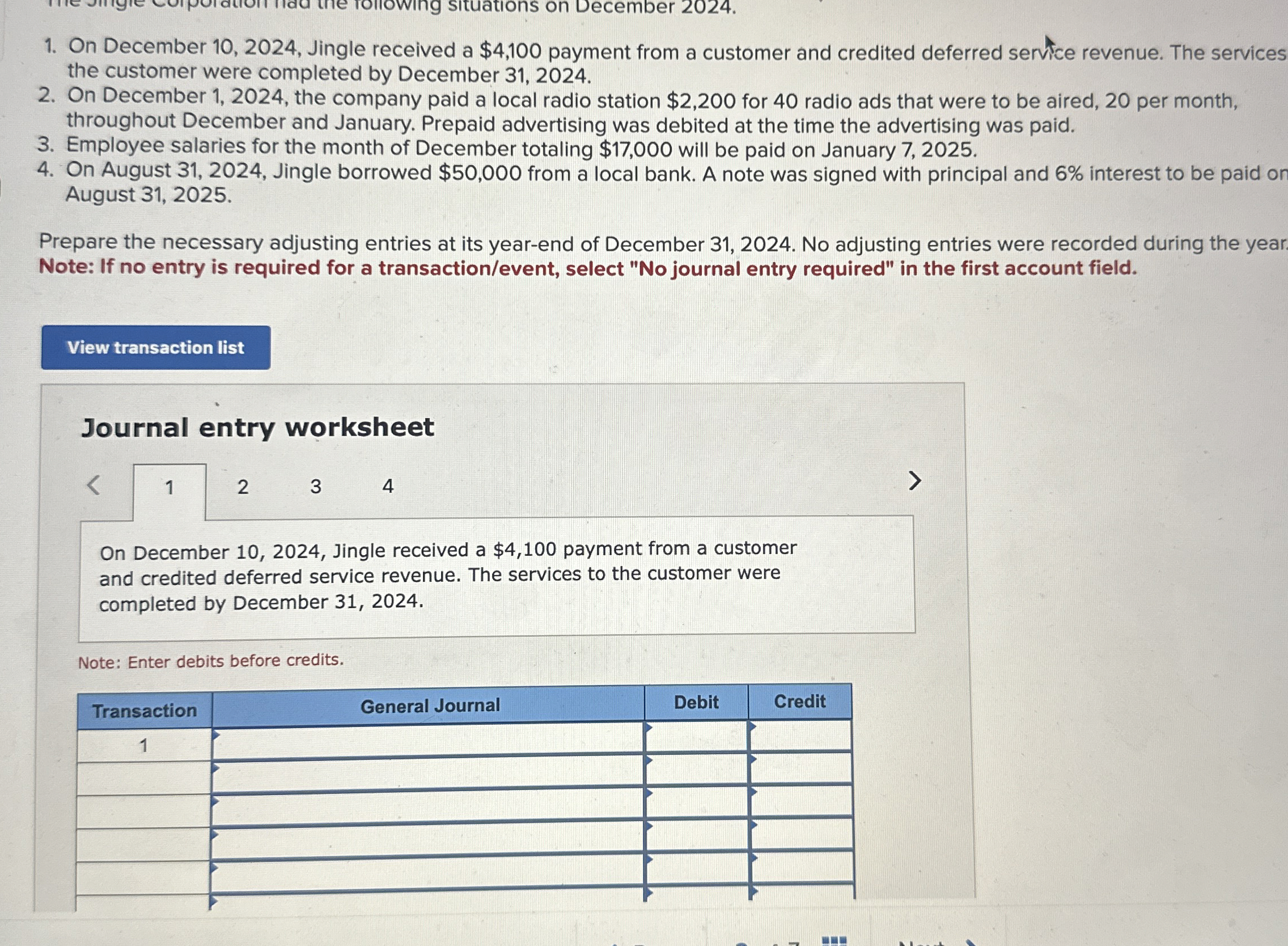

Question: On December 1 0 , 2 0 2 4 , Jingle received a $ 4 , 1 0 0 payment from a customer and credited

On December Jingle received a $ payment from a customer and credited deferred service revenue. The services the customer were completed by December

On December the company paid a local radio station $ for radio ads that were to be aired, per month, throughout December and January. Prepaid advertising was debited at the time the advertising was paid.

Employee salaries for the month of December totaling $ will be paid on January

On August Jingle borrowed $ from a local bank. A note was signed with principal and interest to be paid or August

Prepare the necessary adjusting entries at its yearend of December No adjusting entries were recorded during the year Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

On December Jingle received a $ payment from a customer and credited deferred service revenue. The services to the customer were completed by December

Note: Enter debits before credits.

tableTransactionGeneral Journal,Debit,Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock