Question: On December 1 , 2 0 X 1 , Micro World Incorporation entered into a 1 2 0 - day forward contract to sell 1

On December X Micro World Incorporation entered into a day forward contract to sell Australian dollars A$ Micro Worlds fiscal year ends on December The direct exchange rates follow:

DateSpot RateForward Rate for March XDecember X$ $ December XJanuary XMarch X

Required:

Prepare all journal entries for Micro World Incorporated for the following independent situations:

The forward contract was to manage the foreign currency risks from the sale of furniture for A$ on December X with payment due on March X The forward contract is not designated as a hedge.

The forward contract was to hedge an anticipated sale of furniture on January The sale took place on January with payment due on March X The derivative is designated as a cash flow hedge. The company uses the forward exchange rate to measure hedge effectiveness.

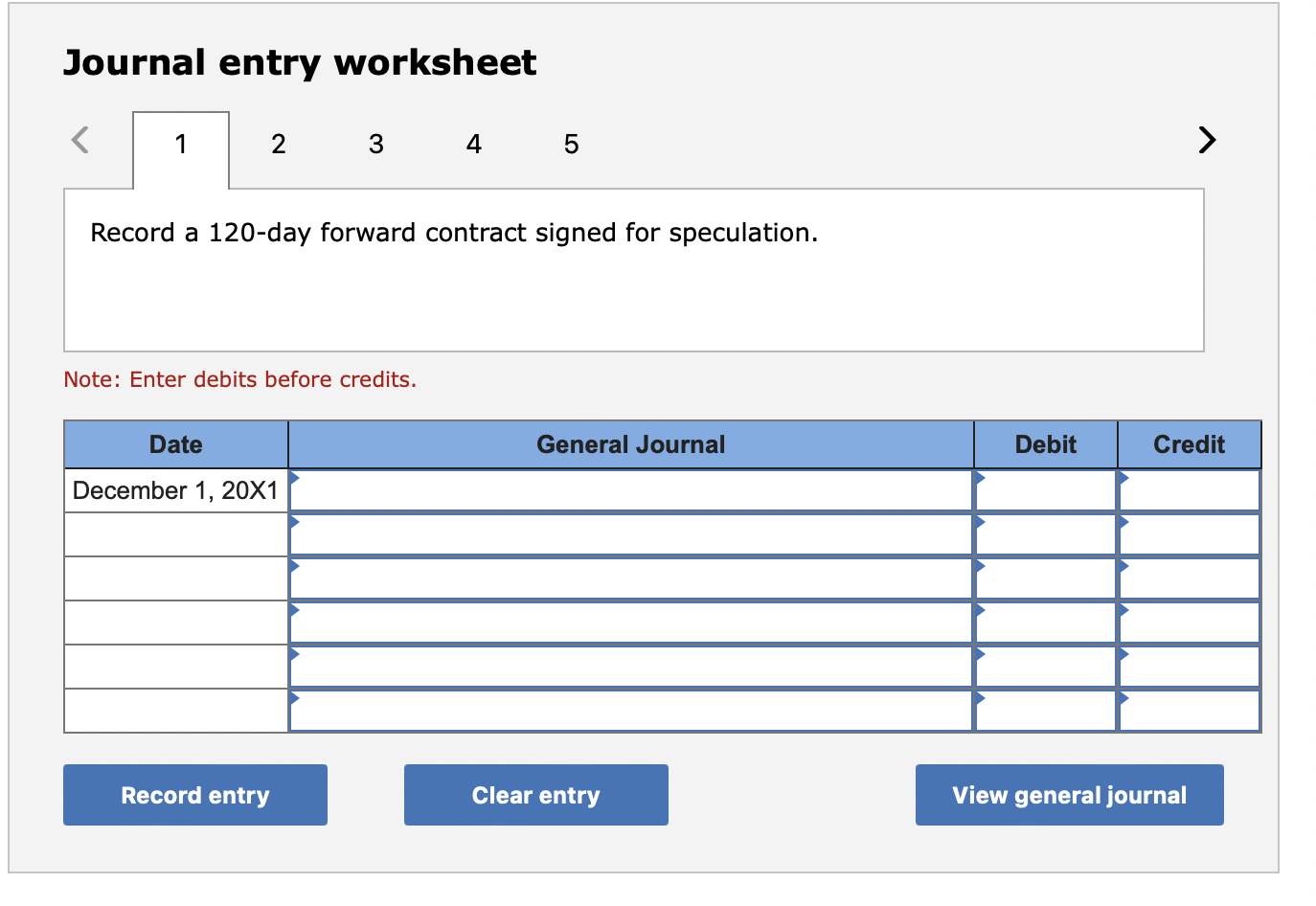

The forward contract was for speculative purposes only. Journal entry worksheet

Record a day forward contract signed for speculation.

Note: Enter debits before credits. Assessment Tool iFrame :ry worksheet

Record the revaluation of the foreign currency payable to the equivalent US dollar value.

Note: Enter debits before credits.

Journal entry worksheet

Record the revaluation of the foreign currency payable.

Note: Enter debits before credits. Journal entry worksheet

Record the receipt of US dollars from an exchange broker as required by the forward contract.

Note: Enter debits before credits. Journal entry worksheet

Record the payment of A$ to the exchange broker in accordance with the forward contract.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock