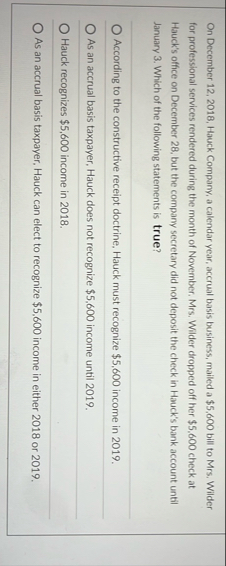

Question: On December 1 2 , 2 0 1 8 , Hauck Company, a calendar year, accrual basis business, mailed a $ 5 , 6 0

On December Hauck Company, a calendar year, accrual basis business, mailed a $ bill to Mrs Wilder for professional services rendered during the month of November. Mrs Wilder dropped off her $ check at Hauck's office on December but the company secretary did not deposit the check in Hauck's bank account until January Which of the following statements is true?

According to the constructive receipt doctrine. Hauck must recognize $ income in

As an accrual basis taxpayer. Hauck does not recognize $ income until

Hauck recognizes $ income in

As an accrual basis taxpayer, Hauck can elect to recognize $ income in either or

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock