On December 1 of the current year, the general ledger of Mossland Company, which was incoporated...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

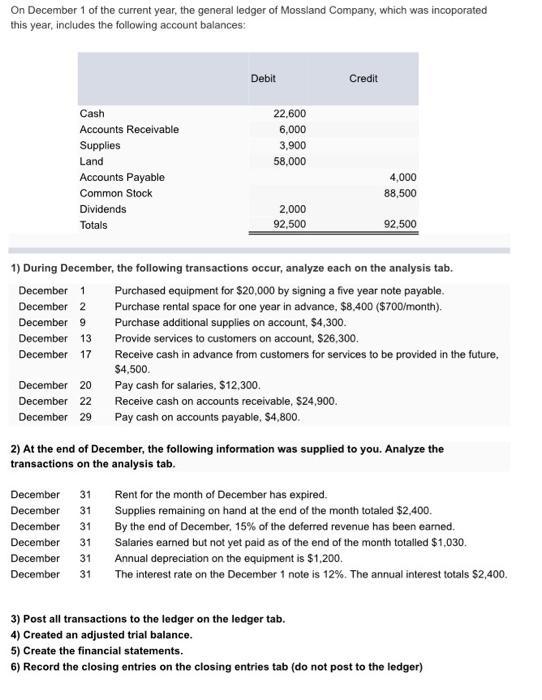

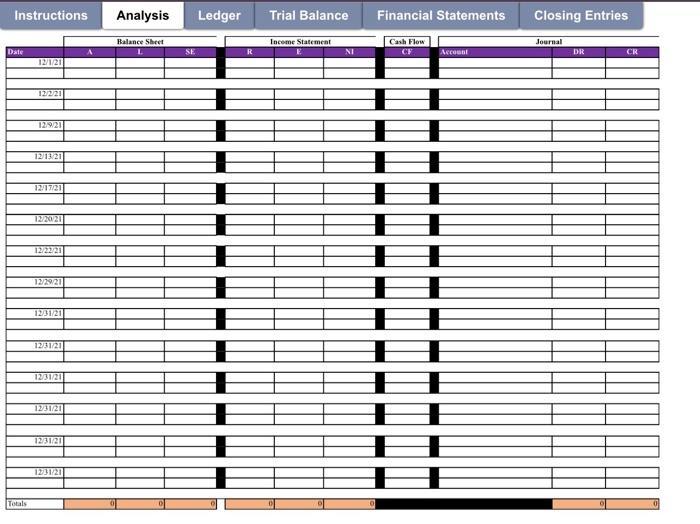

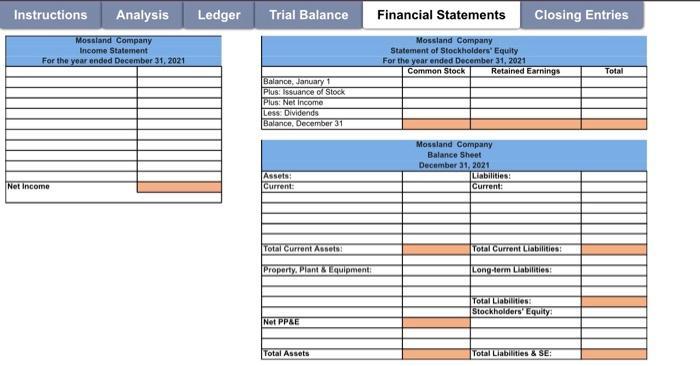

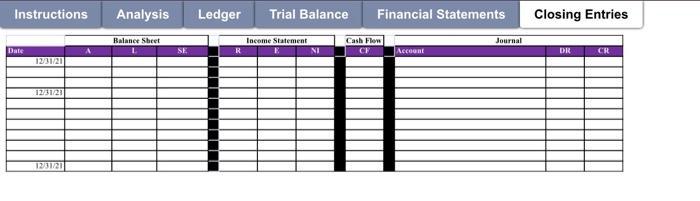

On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit Credit Cash 22,600 6,000 3,900 Accounts Receivable Supplies Land 58,000 4,000 88,500 Accounts Payable Common Stock Dividends 2,000 Totals 92,500 92.500 1) During December, the following transactions occur, analyze each on the analysis tab. December 1 Purchased equipment for $20,000 by signing a five year note payable. Purchase rental space for one year in advance, $8.400 ($700/month). Purchase additional supplies on account, $4,300. Provide services to customers on account, $26,300. December 2 December 9 December 13 December 17 Receive cash in advance from customers for services to be provided in the future, $4,500. December 20 Pay cash for salaries, $12,300. December 22 Receive cash on accounts receivable, $24,900. December 29 Pay cash on accounts payable, $4,800. 2) At the end of December, the following information was supplied to you. Analyze the transactions on the analysis tab. December 31 Rent for the month of December has expired. December 31 Supplies remaining on hand at the end of the month totaled $2,400. December 31 By the end of December, 15% of the deferred revenue has been earned. December 31 Salaries earned but not yet paid as of the end of the month totalled $1,030. December 31 Annual depreciation on the equipment is $1,200. December 31 The interest rate on the December 1 note is 12%. The annual interest totals $2,400. 3) Post all transactions to the ledger on the ledger tab. 4) Created an adjusted trial balance. 5) Create the financial statements. 6) Record the closing entries on the closing entries tab (do not post to the ledger) Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flow Journal Date SE NI CF DR CR Account 12/1/21 12/2/21 129/21 12/13/21 12/17/21 12/20/21 12/22/21 12/29/21 1231/21 12/31/21 1231/21 12/31/21 12/31/21 1231/21 Totals Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Mossland Company Income Statement For the year ended December 31, 2021 Mossland Company Statement of Stockholders' Equity For the year ended December 31, 2021 Common Stock Retained Earnings Total Balance, January 1 Plus: Issuance of Stock Plus: Net Income Less: Dividends Balance, December 31 Mossland Company Balance Sheet December 31, 2021 Assets: Current Liabilities: Current: Net Income Total Current Asnets Total Current Liabilities: Property. Plant & Lquipment Long-term Liabilities: Total Liabilities: Stockholders' Equity: Net PPAE Total Assets Total Liabilities & SE: Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flon Journal Date SE NI CF Account DR CR 1231/21 1231/21 1231/21 On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit Credit Cash 22,600 6,000 3,900 Accounts Receivable Supplies Land 58,000 4,000 88,500 Accounts Payable Common Stock Dividends 2,000 Totals 92,500 92.500 1) During December, the following transactions occur, analyze each on the analysis tab. December 1 Purchased equipment for $20,000 by signing a five year note payable. Purchase rental space for one year in advance, $8.400 ($700/month). Purchase additional supplies on account, $4,300. Provide services to customers on account, $26,300. December 2 December 9 December 13 December 17 Receive cash in advance from customers for services to be provided in the future, $4,500. December 20 Pay cash for salaries, $12,300. December 22 Receive cash on accounts receivable, $24,900. December 29 Pay cash on accounts payable, $4,800. 2) At the end of December, the following information was supplied to you. Analyze the transactions on the analysis tab. December 31 Rent for the month of December has expired. December 31 Supplies remaining on hand at the end of the month totaled $2,400. December 31 By the end of December, 15% of the deferred revenue has been earned. December 31 Salaries earned but not yet paid as of the end of the month totalled $1,030. December 31 Annual depreciation on the equipment is $1,200. December 31 The interest rate on the December 1 note is 12%. The annual interest totals $2,400. 3) Post all transactions to the ledger on the ledger tab. 4) Created an adjusted trial balance. 5) Create the financial statements. 6) Record the closing entries on the closing entries tab (do not post to the ledger) Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flow Journal Date SE NI CF DR CR Account 12/1/21 12/2/21 129/21 12/13/21 12/17/21 12/20/21 12/22/21 12/29/21 1231/21 12/31/21 1231/21 12/31/21 12/31/21 1231/21 Totals Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Mossland Company Income Statement For the year ended December 31, 2021 Mossland Company Statement of Stockholders' Equity For the year ended December 31, 2021 Common Stock Retained Earnings Total Balance, January 1 Plus: Issuance of Stock Plus: Net Income Less: Dividends Balance, December 31 Mossland Company Balance Sheet December 31, 2021 Assets: Current Liabilities: Current: Net Income Total Current Asnets Total Current Liabilities: Property. Plant & Lquipment Long-term Liabilities: Total Liabilities: Stockholders' Equity: Net PPAE Total Assets Total Liabilities & SE: Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flon Journal Date SE NI CF Account DR CR 1231/21 1231/21 1231/21 On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit Credit Cash 22,600 6,000 3,900 Accounts Receivable Supplies Land 58,000 4,000 88,500 Accounts Payable Common Stock Dividends 2,000 Totals 92,500 92.500 1) During December, the following transactions occur, analyze each on the analysis tab. December 1 Purchased equipment for $20,000 by signing a five year note payable. Purchase rental space for one year in advance, $8.400 ($700/month). Purchase additional supplies on account, $4,300. Provide services to customers on account, $26,300. December 2 December 9 December 13 December 17 Receive cash in advance from customers for services to be provided in the future, $4,500. December 20 Pay cash for salaries, $12,300. December 22 Receive cash on accounts receivable, $24,900. December 29 Pay cash on accounts payable, $4,800. 2) At the end of December, the following information was supplied to you. Analyze the transactions on the analysis tab. December 31 Rent for the month of December has expired. December 31 Supplies remaining on hand at the end of the month totaled $2,400. December 31 By the end of December, 15% of the deferred revenue has been earned. December 31 Salaries earned but not yet paid as of the end of the month totalled $1,030. December 31 Annual depreciation on the equipment is $1,200. December 31 The interest rate on the December 1 note is 12%. The annual interest totals $2,400. 3) Post all transactions to the ledger on the ledger tab. 4) Created an adjusted trial balance. 5) Create the financial statements. 6) Record the closing entries on the closing entries tab (do not post to the ledger) Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flow Journal Date SE NI CF DR CR Account 12/1/21 12/2/21 129/21 12/13/21 12/17/21 12/20/21 12/22/21 12/29/21 1231/21 12/31/21 1231/21 12/31/21 12/31/21 1231/21 Totals Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Mossland Company Income Statement For the year ended December 31, 2021 Mossland Company Statement of Stockholders' Equity For the year ended December 31, 2021 Common Stock Retained Earnings Total Balance, January 1 Plus: Issuance of Stock Plus: Net Income Less: Dividends Balance, December 31 Mossland Company Balance Sheet December 31, 2021 Assets: Current Liabilities: Current: Net Income Total Current Asnets Total Current Liabilities: Property. Plant & Lquipment Long-term Liabilities: Total Liabilities: Stockholders' Equity: Net PPAE Total Assets Total Liabilities & SE: Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flon Journal Date SE NI CF Account DR CR 1231/21 1231/21 1231/21 On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit Credit Cash 22,600 6,000 3,900 Accounts Receivable Supplies Land 58,000 4,000 88,500 Accounts Payable Common Stock Dividends 2,000 Totals 92,500 92.500 1) During December, the following transactions occur, analyze each on the analysis tab. December 1 Purchased equipment for $20,000 by signing a five year note payable. Purchase rental space for one year in advance, $8.400 ($700/month). Purchase additional supplies on account, $4,300. Provide services to customers on account, $26,300. December 2 December 9 December 13 December 17 Receive cash in advance from customers for services to be provided in the future, $4,500. December 20 Pay cash for salaries, $12,300. December 22 Receive cash on accounts receivable, $24,900. December 29 Pay cash on accounts payable, $4,800. 2) At the end of December, the following information was supplied to you. Analyze the transactions on the analysis tab. December 31 Rent for the month of December has expired. December 31 Supplies remaining on hand at the end of the month totaled $2,400. December 31 By the end of December, 15% of the deferred revenue has been earned. December 31 Salaries earned but not yet paid as of the end of the month totalled $1,030. December 31 Annual depreciation on the equipment is $1,200. December 31 The interest rate on the December 1 note is 12%. The annual interest totals $2,400. 3) Post all transactions to the ledger on the ledger tab. 4) Created an adjusted trial balance. 5) Create the financial statements. 6) Record the closing entries on the closing entries tab (do not post to the ledger) Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flow Journal Date SE NI CF DR CR Account 12/1/21 12/2/21 129/21 12/13/21 12/17/21 12/20/21 12/22/21 12/29/21 1231/21 12/31/21 1231/21 12/31/21 12/31/21 1231/21 Totals Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Mossland Company Income Statement For the year ended December 31, 2021 Mossland Company Statement of Stockholders' Equity For the year ended December 31, 2021 Common Stock Retained Earnings Total Balance, January 1 Plus: Issuance of Stock Plus: Net Income Less: Dividends Balance, December 31 Mossland Company Balance Sheet December 31, 2021 Assets: Current Liabilities: Current: Net Income Total Current Asnets Total Current Liabilities: Property. Plant & Lquipment Long-term Liabilities: Total Liabilities: Stockholders' Equity: Net PPAE Total Assets Total Liabilities & SE: Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flon Journal Date SE NI CF Account DR CR 1231/21 1231/21 1231/21 On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit Credit Cash 22,600 6,000 3,900 Accounts Receivable Supplies Land 58,000 4,000 88,500 Accounts Payable Common Stock Dividends 2,000 Totals 92,500 92.500 1) During December, the following transactions occur, analyze each on the analysis tab. December 1 Purchased equipment for $20,000 by signing a five year note payable. Purchase rental space for one year in advance, $8.400 ($700/month). Purchase additional supplies on account, $4,300. Provide services to customers on account, $26,300. December 2 December 9 December 13 December 17 Receive cash in advance from customers for services to be provided in the future, $4,500. December 20 Pay cash for salaries, $12,300. December 22 Receive cash on accounts receivable, $24,900. December 29 Pay cash on accounts payable, $4,800. 2) At the end of December, the following information was supplied to you. Analyze the transactions on the analysis tab. December 31 Rent for the month of December has expired. December 31 Supplies remaining on hand at the end of the month totaled $2,400. December 31 By the end of December, 15% of the deferred revenue has been earned. December 31 Salaries earned but not yet paid as of the end of the month totalled $1,030. December 31 Annual depreciation on the equipment is $1,200. December 31 The interest rate on the December 1 note is 12%. The annual interest totals $2,400. 3) Post all transactions to the ledger on the ledger tab. 4) Created an adjusted trial balance. 5) Create the financial statements. 6) Record the closing entries on the closing entries tab (do not post to the ledger) Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flow Journal Date SE NI CF DR CR Account 12/1/21 12/2/21 129/21 12/13/21 12/17/21 12/20/21 12/22/21 12/29/21 1231/21 12/31/21 1231/21 12/31/21 12/31/21 1231/21 Totals Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Mossland Company Income Statement For the year ended December 31, 2021 Mossland Company Statement of Stockholders' Equity For the year ended December 31, 2021 Common Stock Retained Earnings Total Balance, January 1 Plus: Issuance of Stock Plus: Net Income Less: Dividends Balance, December 31 Mossland Company Balance Sheet December 31, 2021 Assets: Current Liabilities: Current: Net Income Total Current Asnets Total Current Liabilities: Property. Plant & Lquipment Long-term Liabilities: Total Liabilities: Stockholders' Equity: Net PPAE Total Assets Total Liabilities & SE: Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flon Journal Date SE NI CF Account DR CR 1231/21 1231/21 1231/21 On December 1 of the current year, the general ledger of Mossland Company, which was incoporated this year, includes the following account balances: Debit Credit Cash 22,600 6,000 3,900 Accounts Receivable Supplies Land 58,000 4,000 88,500 Accounts Payable Common Stock Dividends 2,000 Totals 92,500 92.500 1) During December, the following transactions occur, analyze each on the analysis tab. December 1 Purchased equipment for $20,000 by signing a five year note payable. Purchase rental space for one year in advance, $8.400 ($700/month). Purchase additional supplies on account, $4,300. Provide services to customers on account, $26,300. December 2 December 9 December 13 December 17 Receive cash in advance from customers for services to be provided in the future, $4,500. December 20 Pay cash for salaries, $12,300. December 22 Receive cash on accounts receivable, $24,900. December 29 Pay cash on accounts payable, $4,800. 2) At the end of December, the following information was supplied to you. Analyze the transactions on the analysis tab. December 31 Rent for the month of December has expired. December 31 Supplies remaining on hand at the end of the month totaled $2,400. December 31 By the end of December, 15% of the deferred revenue has been earned. December 31 Salaries earned but not yet paid as of the end of the month totalled $1,030. December 31 Annual depreciation on the equipment is $1,200. December 31 The interest rate on the December 1 note is 12%. The annual interest totals $2,400. 3) Post all transactions to the ledger on the ledger tab. 4) Created an adjusted trial balance. 5) Create the financial statements. 6) Record the closing entries on the closing entries tab (do not post to the ledger) Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flow Journal Date SE NI CF DR CR Account 12/1/21 12/2/21 129/21 12/13/21 12/17/21 12/20/21 12/22/21 12/29/21 1231/21 12/31/21 1231/21 12/31/21 12/31/21 1231/21 Totals Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Mossland Company Income Statement For the year ended December 31, 2021 Mossland Company Statement of Stockholders' Equity For the year ended December 31, 2021 Common Stock Retained Earnings Total Balance, January 1 Plus: Issuance of Stock Plus: Net Income Less: Dividends Balance, December 31 Mossland Company Balance Sheet December 31, 2021 Assets: Current Liabilities: Current: Net Income Total Current Asnets Total Current Liabilities: Property. Plant & Lquipment Long-term Liabilities: Total Liabilities: Stockholders' Equity: Net PPAE Total Assets Total Liabilities & SE: Instructions Analysis Ledger Trial Balance Financial Statements Closing Entries Balance Sheet Income Statement Cash Flon Journal Date SE NI CF Account DR CR 1231/21 1231/21 1231/21

Expert Answer:

Answer rating: 100% (QA)

Mossland Company Balance Sheet Income Statement Cash Flow Journal Date A L SE R E NI CF Accounts Deb... View the full answer

Related Book For

Intermediate Accounting

ISBN: 978-0324659139

11th edition

Authors: Loren A. Nikolai, John D. Bazley, Jefferson P. Jones

Posted Date:

Students also viewed these accounting questions

-

On December 1 of the current year, Jordan, Inc., assigns $125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a $750 service fee, advances 85% of Jordans...

-

On March 1 of the current year G, who operates a wholesale business, leased a new warehouse space and immediately spent $150,000 improving the interior of the building. The lease contract is for 4...

-

On December 1 of the current year, Jordan Inc. assigns $110,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges an $850 service fee, advances 80% of Jordans...

-

1) Identify the population and sample from the following statements: a) A survey conducted at NSU has found that out of 371 students, 52 are left-handed b) In a rescue shelter, the height and weight...

-

A Canadian paper manufacturer sells much of its paper in the United States. The manufacturer is paid in U.S. dollars but pays its employees in Canadian dollars. The manufacturer is interested in the...

-

The following are hypothetical data for the U.S. balance of payments. Use the data to calculate each of the following (assume credit balances): a. Merchandise trade balance b. Balance on goods and...

-

Let the continuous random variable \(X\) denote the current measured in a thin copper wire in milliamperes. Assume that the range of \(X\) is \([4.9,5.1] \mathrm{mA}\), and assume that the...

-

On July 1, 2013, Ross-Livermore Industries issued nine-month notes in the amount of $400 million. Interest is payable at maturity. Required: Determine the amount of interest expense that should be...

-

1) Find any evidence you can on an internet search that car-washes in California need to worry for their future. 2) Many people like BEVMO for purchasing alcohol and drink-related goods. There may be...

-

List the people and groups of people who are likely to be interested in financial statements.

-

A 1530 kg car is towing a 300kg trailer the coefficient of friction between all tires and the road is 0.80. The car and trailer are traveling at 100km/h around a banked curve or raduius zoom. What is...

-

Apple's balance sheet. Go to Apple's website to review the company's most recent annual report. Find the balance sheet and the corresponding discussion. Using concepts from the chapter, review and...

-

The Internet of Things (IoT), as discussed in Chapter 14, has blurred the line between products and services - and, as a result, taxes. The issue is how companies are taxed, because products are...

-

Look at the following research article to see how the statistical techniques you have already learned are used in practice: Watson, J., Kinstler, A., Vidonish III, W. P., Wagner, M., Li, L., Davis,...

-

Explain how Adelphia misreported non-GAAP information.

-

Letter to Shareholders. Berkshire Hathaway's annual letter to shareholders, written by CEO Warren Buffett, happens to be one of the most interesting, down-toearth, folksy, and unique communications...

-

what is smart lock? what are its objectives? what promotions can we run? how can the digital market work?

-

Provide a draft/outline of legal research involving an indigenous Canadian woman charged with assault causing bodily harm under (Sec 267b) of the Criminal Code, where the crown wants a 12-month jail...

-

Notting Hill Company incurs the following costs for R&D activities: Material used from inventory ............... $15,000 Equipment purchased for R&D with no other use ....... 85,000 Depreciation on...

-

On January 1, 2010, Boiler Company received two notes for merchandise sold: Note 1: A $10,000, 10%, 60-day note from Wildcat, Inc. Note 2: A $20,000, 8%, three-year interest-bearing note from Gopher,...

-

The Gravais Company made two purchases on December 29, 2010. One purchase for $3,000 was shipped FOB destination, and the second for $4,000 was shipped FOB shipping point. Neither purchase had been...

-

Which of the following does not occur in the small intestine? (a) Bile from the gall bladder breaks fats into small droplets. (b) Nutrients are absorbed into the body. (c) Proteins are broken down....

-

Which blood vessels are responsible for nutrient and waste exchange with tissues?

-

Trace the path of blood through the body, beginning with blood returning from the tissues to the heart. Be sure to name each of the chambers of the heart.

Study smarter with the SolutionInn App