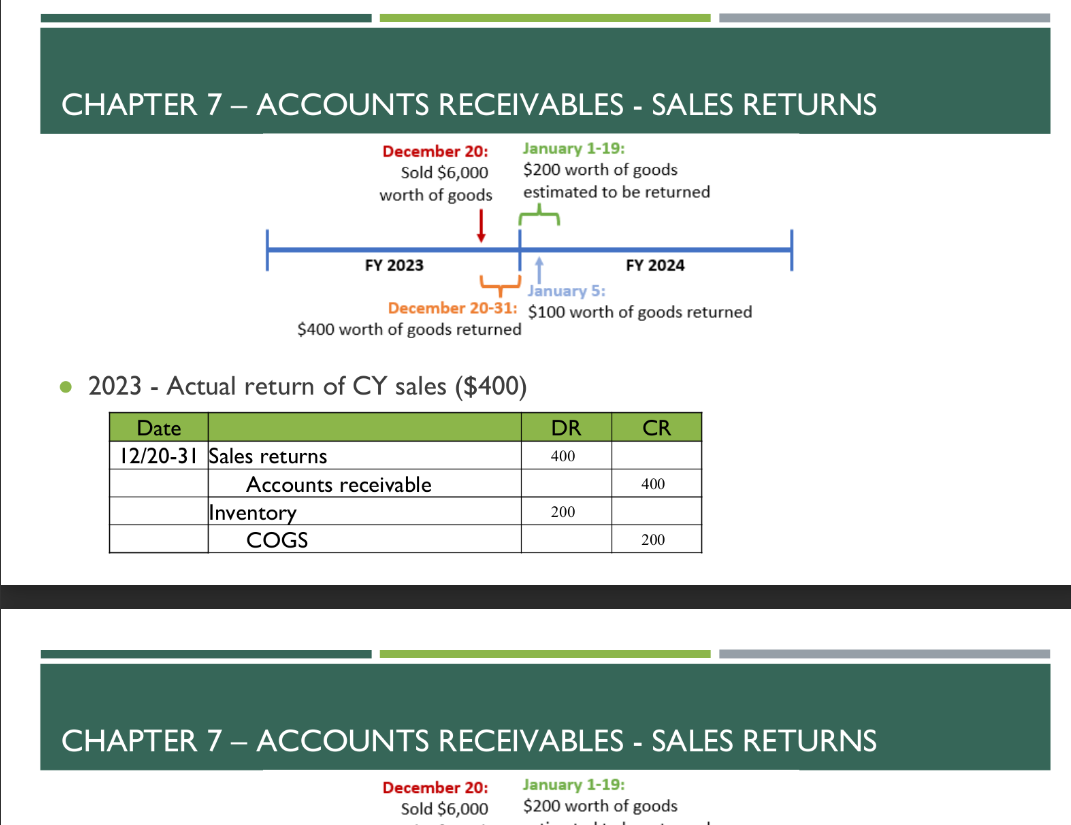

Question: On December 2 0 , 2 0 2 3 , Lucille Corp sold merchandise at a price of $ 6 , 0 0 0 on

On December Lucille Corp sold merchandise at a price of $ on account. Lucille delivered the merchandise on December but they offer a day return window. Based on historical data, Lucille estimates of the merchandise will be returned. As of December $ worth of merchandise has been returned. On January $ worth of merchandise is returned.

Please write the correct journal entry for this and PLEASE EXPLAIN each step properly. My teacher's explanation is not fully correct. I am confused with this part. Why is she not recording one entry as estimated sales returns and why is she adding refund liability?

CHAPTER ACCOUNTS RECEIVABLES SALES RETURNS

December : $ worth of goods returned

$ worth of goods returned

Actual return of CY sales $

CHAPTER ACCOUNTS RECEIVABLES SALES RETURNS

December :

January :

Sold $

$ worth of goods

Estimated return of CY sale $

CHAPTER ACCOUNTS RECEIVABLES SALES RETURNS

$ worth of goods returned

Actual return of PY sale $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock