Question: On December 3 0 , Year 1 , Bart, Inc. purchased a machine from Fell Corp. in exchange for a noninterest bearing note requiring eight

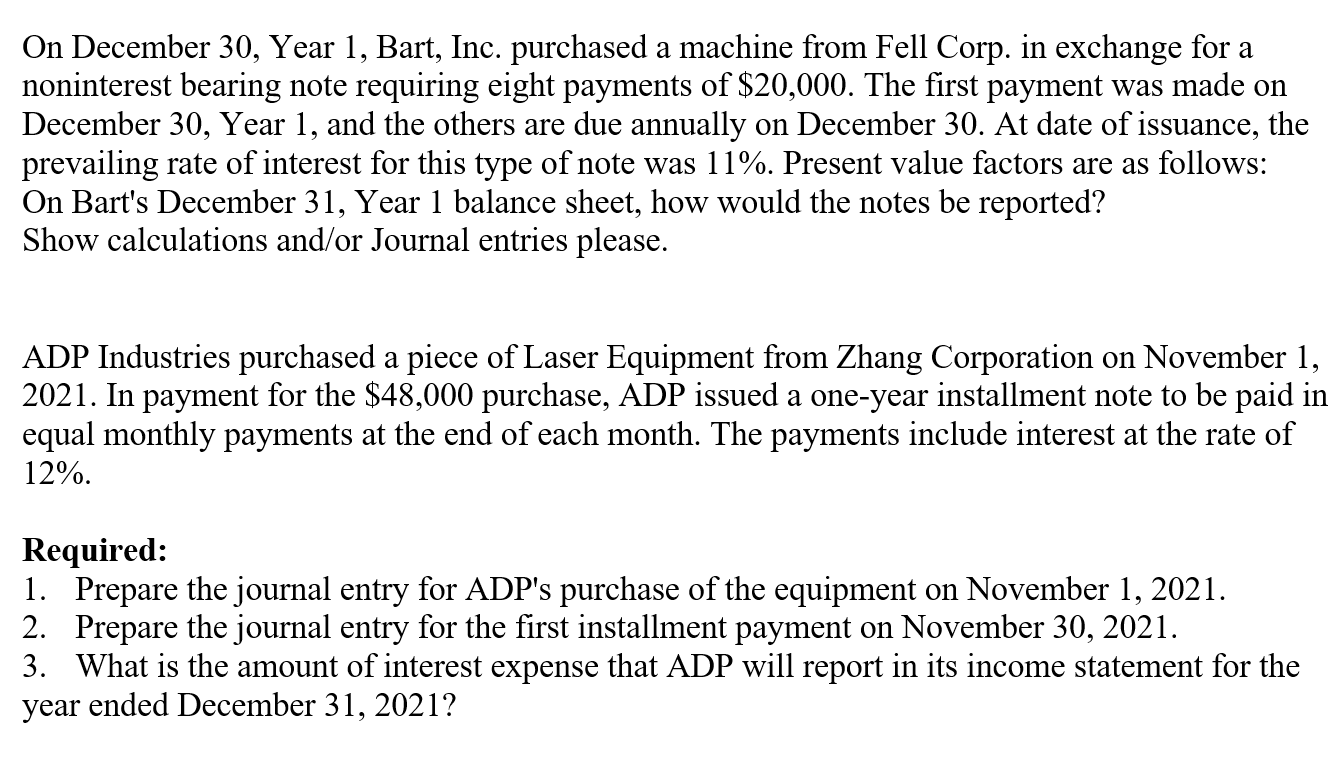

On December Year Bart, Inc. purchased a machine from Fell Corp. in exchange for a

noninterest bearing note requiring eight payments of $ The first payment was made on

December Year and the others are due annually on December At date of issuance, the

prevailing rate of interest for this type of note was Present value factors are as follows:

On Bart's December Year balance sheet, how would the notes be reported?

Show calculations andor Journal entries please.

ADP Industries purchased a piece of Laser Equipment from Zhang Corporation on November

In payment for the $ purchase, ADP issued a oneyear installment note to be paid in

equal monthly payments at the end of each month. The payments include interest at the rate of

Required:

Prepare the journal entry for ADP's purchase of the equipment on November

Prepare the journal entry for the first installment payment on November

What is the amount of interest expense that ADP will report in its income statement for the

year ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock