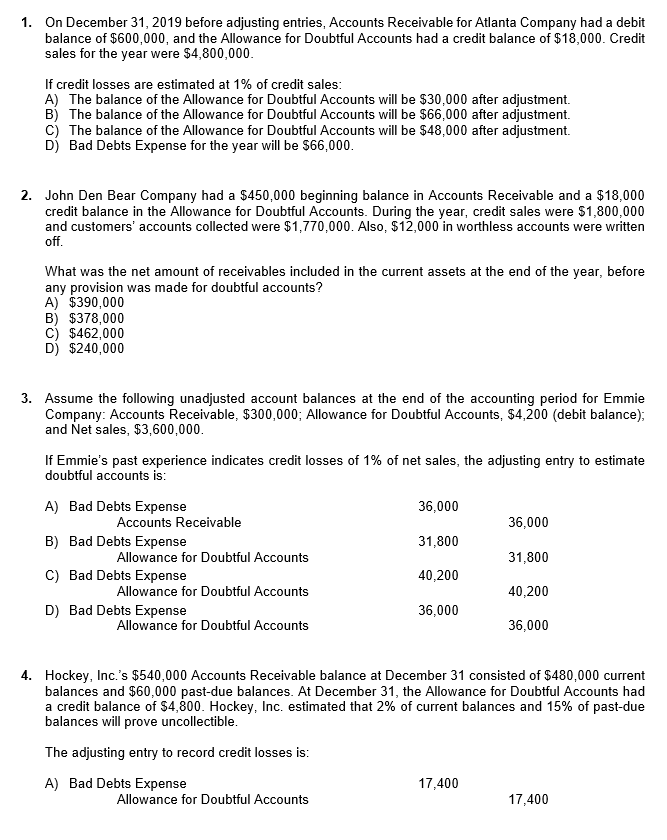

Question: On December 3 1 , 2 0 1 9 before adjusting entries, Accounts Receivable for Atlanta Company had a debit balance of $ 6 0

On December before adjusting entries, Accounts Receivable for Atlanta Company had a debit

balance of $ and the Allowance for Doubtful Accounts had a credit balance of $ Credit

sales for the year were $

If credit losses are estimated at of credit sales:

A The balance of the Allowance for Doubtful Accounts will be $ after adjustment.

B The balance of the Allowance for Doubtful Accounts will be $ after adjustment.

C The balance of the Allowance for Doubtful Accounts will be $ after adjustment.

D Bad Debts Expense for the year will be $

John Den Bear Company had a $ beginning balance in Accounts Receivable and a $

credit balance in the Allowance for Doubtful Accounts. During the year, credit sales were $

and customers' accounts collected were $ Also, $ in worthless accounts were written

off.

What was the net amount of receivables included in the current assets at the end of the year, before

any provision was made for doubtful accounts?

A $

B $

C $

D $

Assume the following unadjusted account balances at the end of the accounting period for Emmie

Company: Accounts Receivable, $; Allowance for Doubtful Accounts, $debit balance;

and Net sales, $

If Emmie's past experience indicates credit losses of of net sales, the adjusting entry to estimate

doubtful accounts is:

A Bad Debts Expense

Accounts Receivable

B Bad Debts Expense

Allowance for Doubtful Accounts

C Bad Debts Expense

Allowance for Doubtful Accounts

D Bad Debts Expense

Allowance for Doubtful Accounts

Hockey, Inc.s $ Accounts Receivable balance at December consisted of $ current

balances and $ pastdue balances. At December the Allowance for Doubtful Accounts had

a credit balance of $ Hockey, Inc. estimated that of current balances and of pastdue

balances will prove uncollectible.

The adjusting entry to record credit losses is:

A Bad Debts Expense

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock