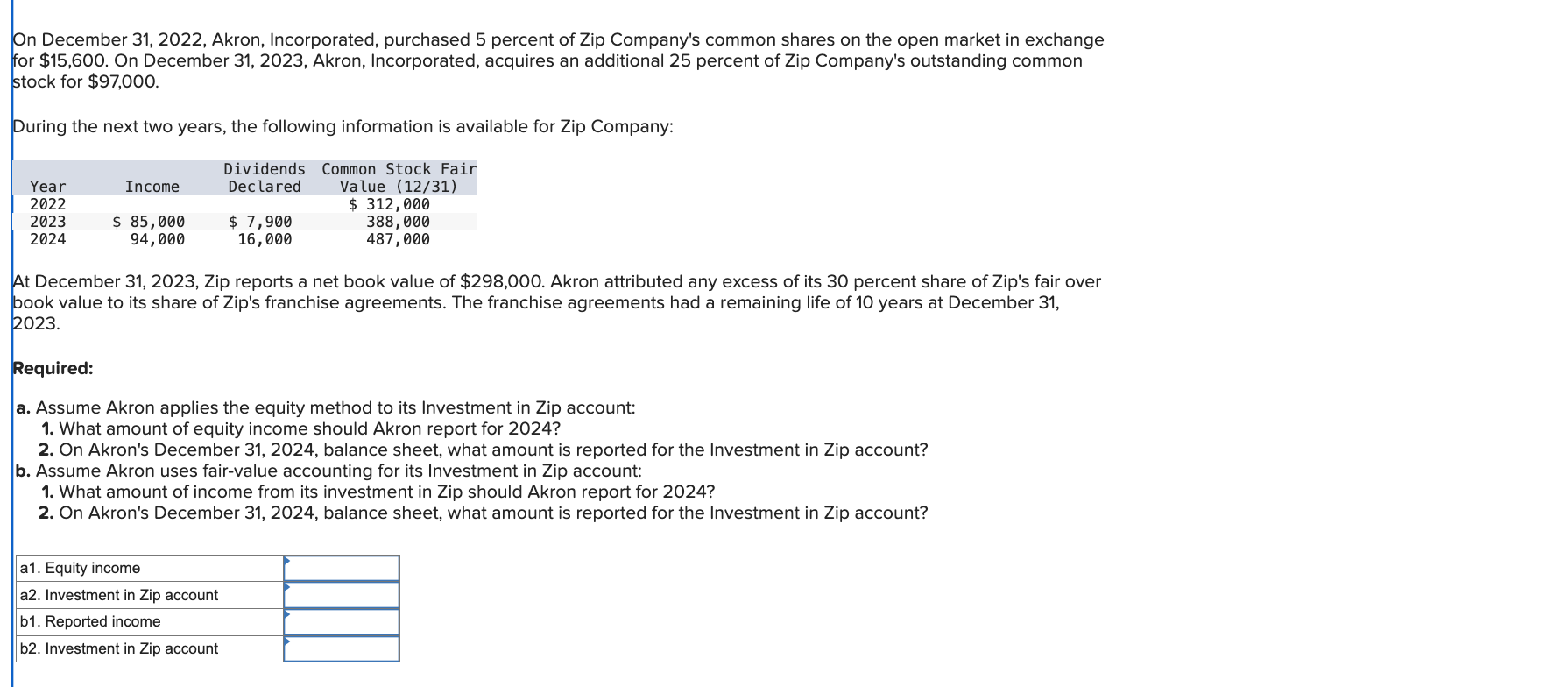

Question: On December 3 1 , 2 0 2 2 , Akron, Incorporated, purchased 5 percent of Zip Company's common shares on the open market in

On December Akron, Incorporated, purchased percent of Zip Company's common shares on the open market in exchange

for $ On December Akron, Incorporated, acquires an additional percent of Zip Company's outstanding common

stock for $

During the next two years, the following information is available for Zip Company:

At December Zip reports a net book value of $ Akron attributed any excess of its percent share of Zip's fair over

book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of years at December

Required:

a Assume Akron applies the equity method to its Investment in Zip account:

What amount of equity income should Akron report for

On Akron's December balance sheet, what amount is reported for the Investment in Zip account?

b Assume Akron uses fairvalue accounting for its Investment in Zip account:

What amount of income from its investment in Zip should Akron report for

On Akron's December balance sheet, what amount is reported for the Investment in Zip account?

a Equity income

a Investment in Zip account

b Reported income

b Investment in Zip account

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock