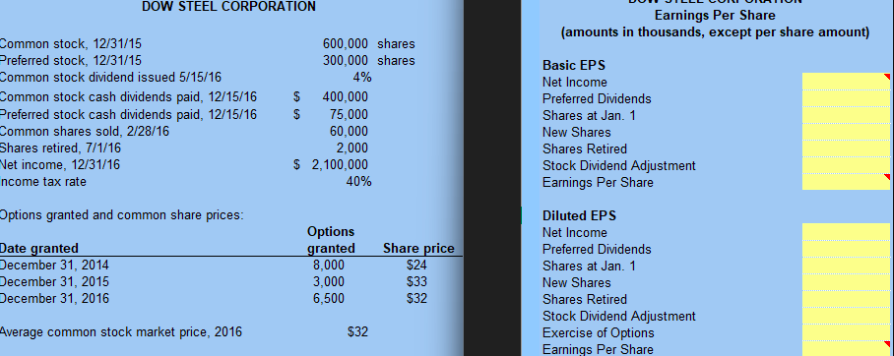

Question: On December 3 1 , 2 0 2 3 , Dow Steel Corporation had 6 0 0 , 0 0 0 shares of common stock

On December Dow Steel Corporation had shares of common stock and shares of noncumulative, nonconvertible preferred stock issued and outstanding. Dow issued a common stock dividend on May and paid cash dividends of $ and $ to common and preferred shareholders, respectively, on December On February Dow sold common shares. In keeping with its long term share repurchase plan, shares were retired on July Dow's net income for the year ended December was $ The income tax rate is As part of an incentive compensation plan, Dow granted incentive stock options to division managers at Dec of the current and each of the previous two years. Each option permits its holder to buy one share of common stock at an exercise price equal to market value at the date of grant and can be exercised one year from that date. Compute Dow's earnings per share basic and diluted for the year ended December using the excel sheet. Note: All info on Dow Steel is on the left. On the right is the format of the excel that needs to be completed. PLEASE COMPLETE THE EXCEL SHEET ON THE RIGHT. Please show work and follow instructions. Thank you!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock