Question: On December 3 1 , 2 0 2 3 , Martin Company had outstanding 1 8 0 , 0 0 0 shares of common stock

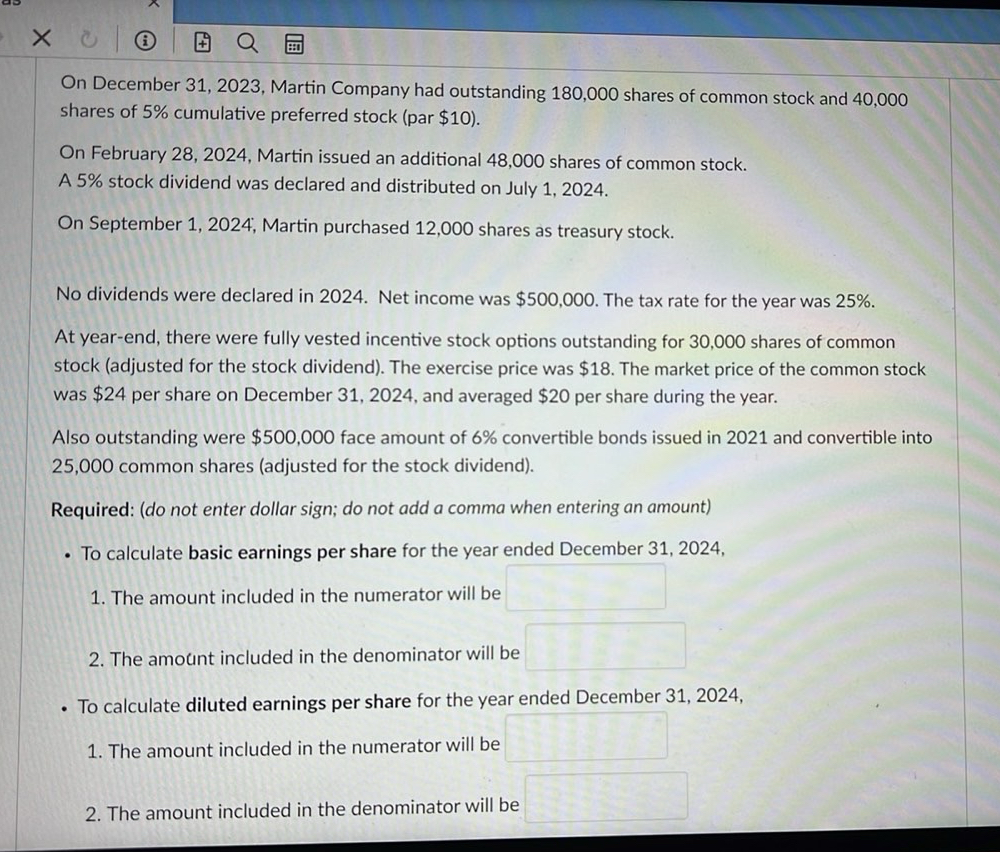

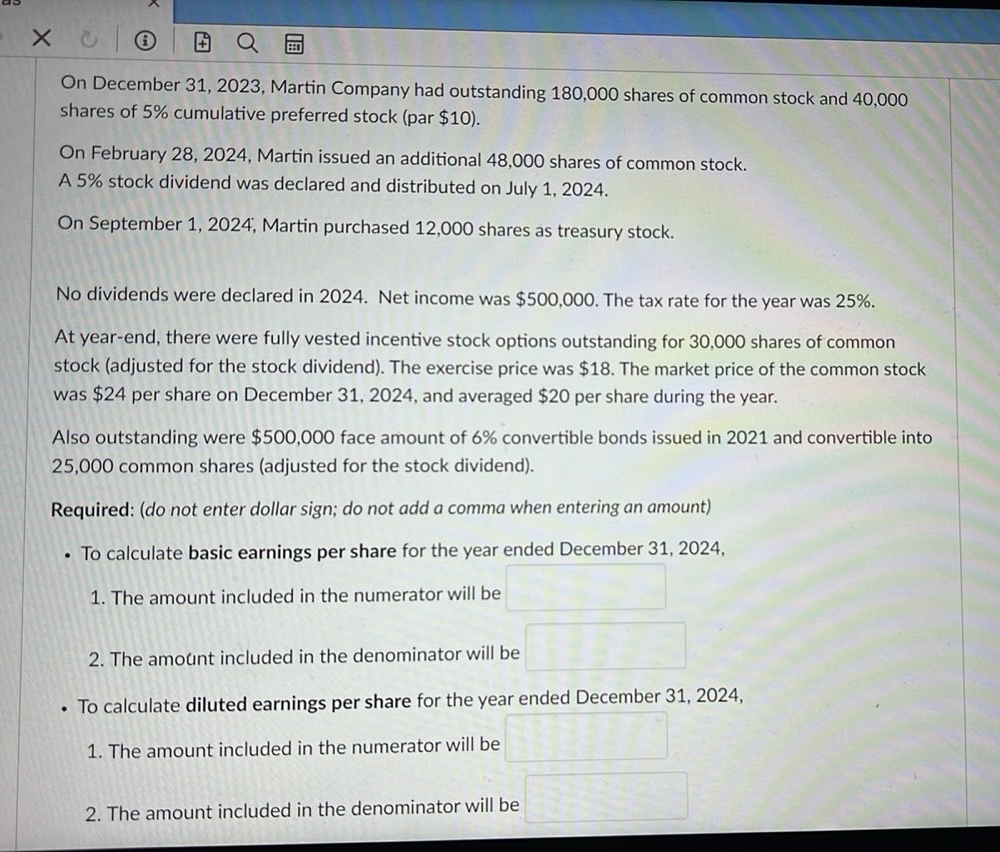

On December Martin Company had outstanding shares of common stock and shares of cumulative preferred stock par $

On February Martin issued an additional shares of common stock.

A stock dividend was declared and distributed on July

On September ; Martin purchased shares as treasury stock.

No dividends were declared in Net income was $ The tax rate for the year was

At yearend, there were fully vested incentive stock options outstanding for shares of common stock adjusted for the stock dividend The exercise price was $ The market price of the common stock was $ per share on December and averaged $ per share during the year.

Also outstanding were $ face amount of convertible bonds issued in and convertible into common shares adjusted for the stock dividend

Required: do not enter dollar sign; do not add a comma when entering an amount

To calculate basic earnings per share for the year ended December

The amount included in the numerator will be

The amount included in the denominator will be

To calculate diluted earnings per share for the year ended December

The amount included in the numerator will be

The amount included in the denominator will be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock