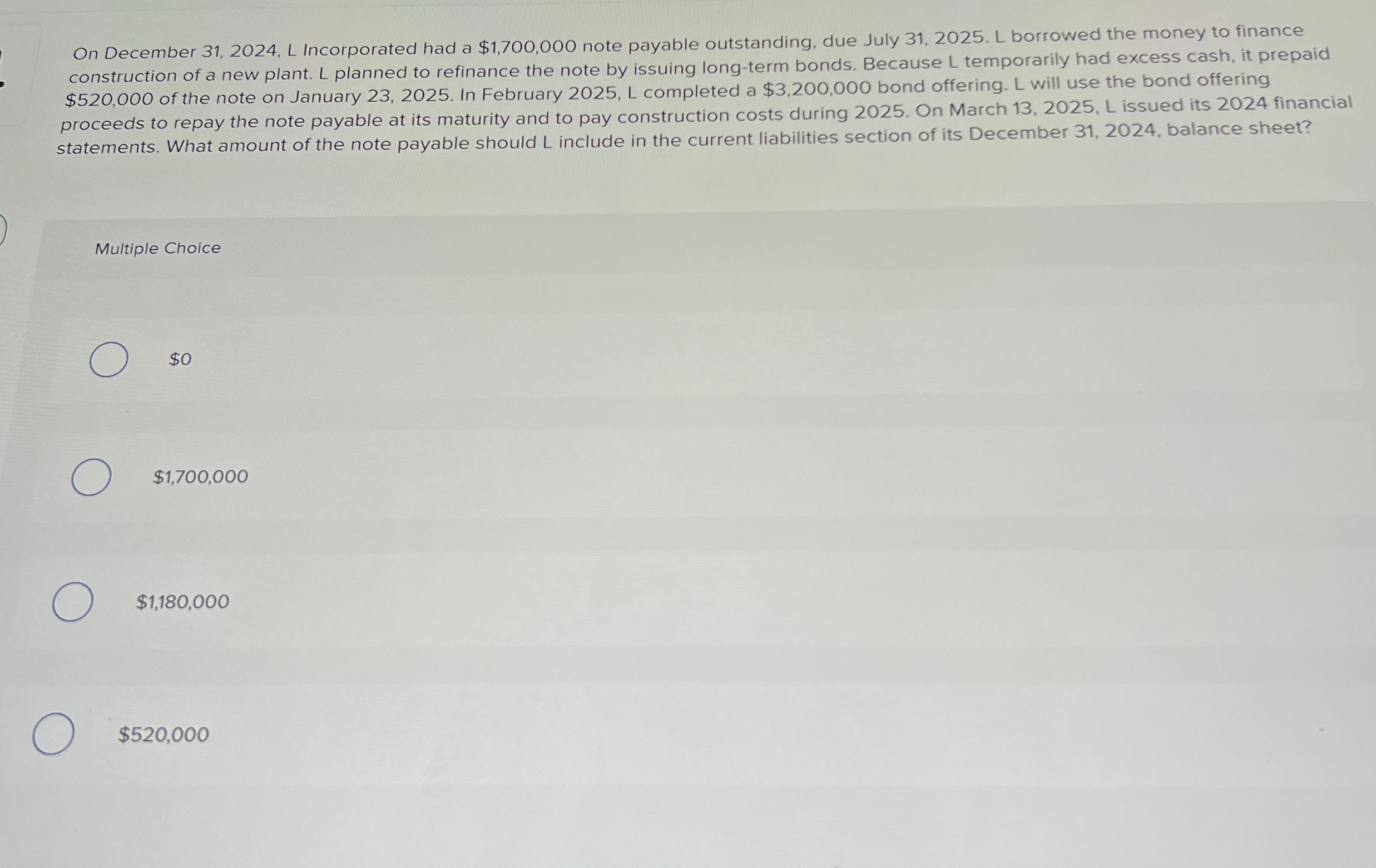

Question: On December 3 1 , 2 0 2 4 , L Incorporated had a $ 1 , 7 0 0 , 0 0 0 note

On December L Incorporated had a $ note payable outstanding, due July L borrowed the money to finance construction of a new plant. L planned to refinance the note by issuing longterm bonds. Because temporarily had excess cash, it prepaid $ of the note on January In February L completed a $ bond offering. L will use the bond offering proceeds to repay the note payable at its maturity and to pay construction costs during On March Lissued its financial statements. What amount of the note payable should L include in the current liabilities section of its December balance sheet?

Multiple Choice

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock