Question: On December 3 1 , 2 0 2 4 , Panther Company issued 2 0 , 0 0 0 shares of its common stock with

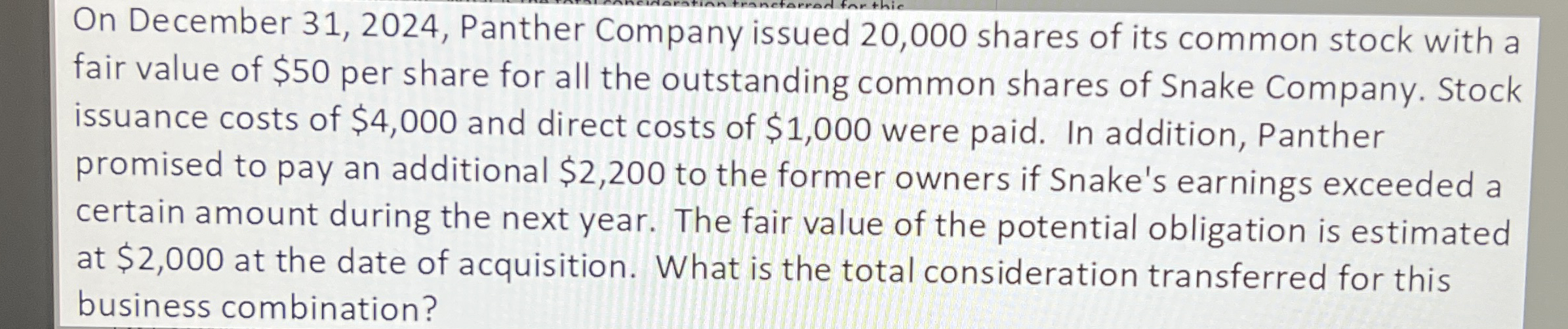

On December Panther Company issued shares of its common stock with a fair value of $ per share for all the outstanding common shares of Snake Company. Stock issuance costs of $ and direct costs of $ were paid. In addition, Panther promised to pay an additional $ to the former owners if Snake's earnings exceeded a certain amount during the next year. The fair value of the potential obligation is estimated at $ at the date of acquisition. What is the total consideration transferred for this business combination?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock