Question: On December 3 1 , 2 0 2 5 , Tamarisk Company signed a $ 1 , 2 8 4 , 3 0 0

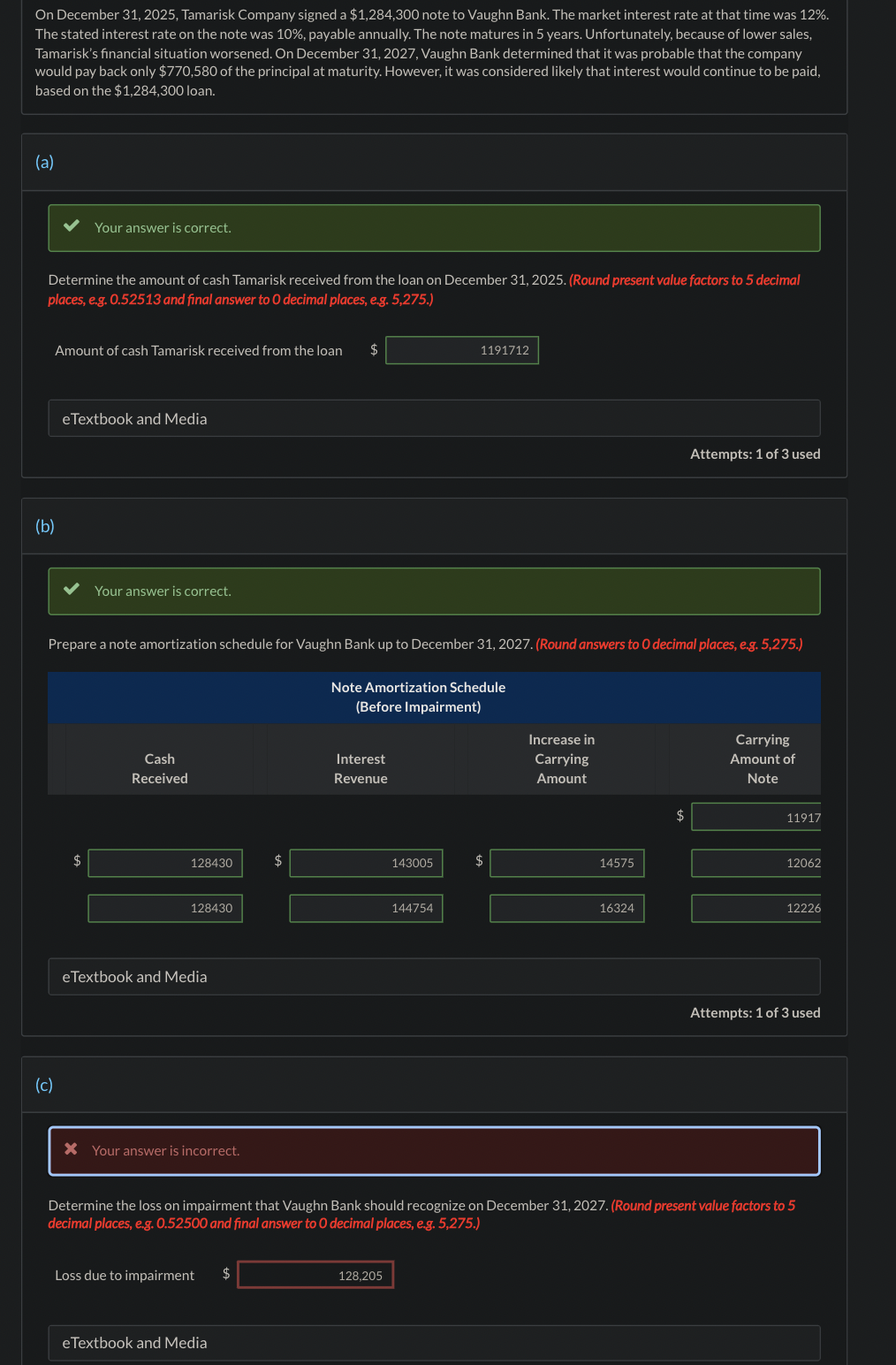

On December Tamarisk Company signed a $ note to Vaughn Bank. The market interest rate at that time was The stated interest rate on the note was payable annually. The note matures in years. Unfortunately, because of lower sales, Tamarisk's financial situation worsened. On December Vaughn Bank determined that it was probable that the company would pay back only $ of the principal at maturity. However, it was considered likely that interest would continue to be paid, based on the $ loan.

a

Your answer is correct.

Determine the amount of cash Tamarisk received from the loan on December Round present value factors to decimal places, eg and final answer to decimal places, eg

Amount of cash Tamarisk received from the loan

eTextbook and Media

Attempts: of used

b

Your answer is correct.

Prepare a note amortization schedule for Vaughn Bank up to December Round answers to decimal places, eg

c

Your answer is incorrect.

Determine the loss on impairment that Vaughn Bank should recognize on December Round present value factors to decimal places, eg and final answer to decimal places, eg

Loss due to impairment

$

eTextbook and Media Current Attempt in Progress

Oriole Corporation factors $ of accounts receivable with Kathleen Battle Financing, Inc. on a with recourse basis. Kathleen Battle Financing will collect the receivables. The receivables records are transferred to Kathleen Battle Financing on August Kathleen Battle Financing assesses a finance charge of of the amount of accounts receivable and also reserves an amount equal to of accounts receivable to cover probable adjustments.

b Assume that the conditions are met for a transfer of receivables with recourse to be accounted for as a sale. Prepare the journal entry on August for Oriole to record the sale of receivables, assuming the recourse obligation has a fair value of $ If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock