On December 31, Year 5, Par Company purchased 70% of the outstanding common shares of Sub...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

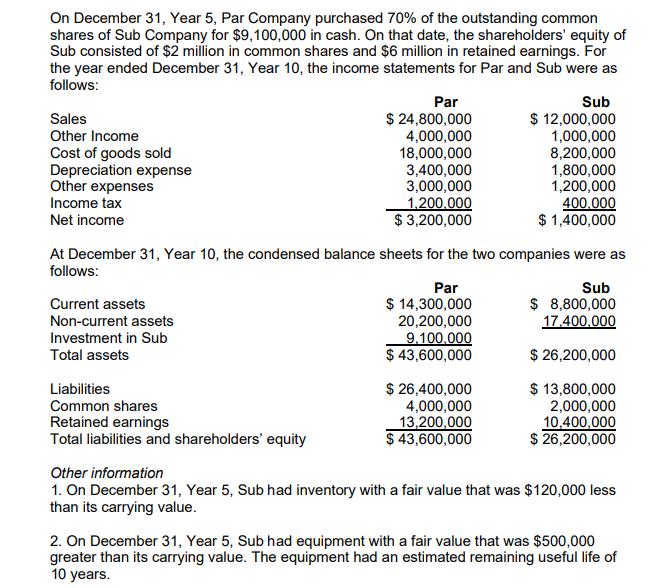

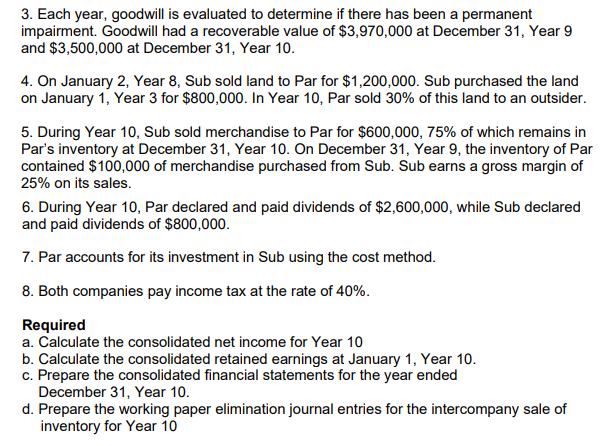

On December 31, Year 5, Par Company purchased 70% of the outstanding common shares of Sub Company for $9,100,000 in cash. On that date, the shareholders' equity of Sub consisted of $2 million in common shares and $6 million in retained earnings. For the year ended December 31, Year 10, the income statements for Par and Sub were as follows: Sales Other Income Cost of goods sold Depreciation expense Other expenses Income tax Net income Current assets Non-current assets Investment in Sub Total assets Par $ 24,800,000 4,000,000 Liabilities Common shares Retained earnings Total liabilities and shareholders' equity 18,000,000 3,400,000 3,000,000 1,200,000 $3,200,000 At December 31, Year 10, the condensed balance sheets for the two companies were as follows: Par $ 14,300,000 20,200,000 9.100.000 $ 43,600,000 Sub $ 12,000,000 1,000,000 8,200,000 1,800,000 1,200,000 400,000 $ 1,400,000 $ 26,400,000 4,000,000 13,200,000 $ 43,600,000 Sub $ 8,800,000 17.400.000 $ 26,200,000 $ 13,800,000 2,000,000 10,400,000 $ 26,200,000 Other information 1. On December 31, Year 5, Sub had inventory with a fair value that was $120,000 less than its carrying value. 2. On December 31, Year 5, Sub had equipment with a fair value that was $500,000 greater than its carrying value. The equipment had an estimated remaining useful life of 10 years. 3. Each year, goodwill is evaluated to determine if there has been a permanent impairment. Goodwill had a recoverable value of $3,970,000 at December 31, Year 9 and $3,500,000 at December 31, Year 10. 4. On January 2, Year 8, Sub sold land to Par for $1,200,000. Sub purchased the land on January 1, Year 3 for $800,000. In Year 10, Par sold 30% of this land to an outsider. 5. During Year 10, Sub sold merchandise to Par for $600,000, 75% of which remains in Par's inventory at December 31, Year 10. On December 31, Year 9, the inventory of Par contained $100,000 of merchandise purchased from Sub. Sub earns a gross margin of 25% on its sales. 6. During Year 10, Par declared and paid dividends of $2,600,000, while Sub declared and paid dividends of $800,000. 7. Par accounts for its investment in Sub using the cost method. 8. Both companies pay income tax at the rate of 40%. Required a. Calculate the consolidated net income for Year 10 b. Calculate the consolidated retained earnings at January 1, Year 10. c. Prepare the consolidated financial statements for the year ended December 31, Year 10. d. Prepare the working paper elimination journal entries for the intercompany sale of inventory for Year 10 On December 31, Year 5, Par Company purchased 70% of the outstanding common shares of Sub Company for $9,100,000 in cash. On that date, the shareholders' equity of Sub consisted of $2 million in common shares and $6 million in retained earnings. For the year ended December 31, Year 10, the income statements for Par and Sub were as follows: Sales Other Income Cost of goods sold Depreciation expense Other expenses Income tax Net income Current assets Non-current assets Investment in Sub Total assets Par $ 24,800,000 4,000,000 Liabilities Common shares Retained earnings Total liabilities and shareholders' equity 18,000,000 3,400,000 3,000,000 1,200,000 $3,200,000 At December 31, Year 10, the condensed balance sheets for the two companies were as follows: Par $ 14,300,000 20,200,000 9.100.000 $ 43,600,000 Sub $ 12,000,000 1,000,000 8,200,000 1,800,000 1,200,000 400,000 $ 1,400,000 $ 26,400,000 4,000,000 13,200,000 $ 43,600,000 Sub $ 8,800,000 17.400.000 $ 26,200,000 $ 13,800,000 2,000,000 10,400,000 $ 26,200,000 Other information 1. On December 31, Year 5, Sub had inventory with a fair value that was $120,000 less than its carrying value. 2. On December 31, Year 5, Sub had equipment with a fair value that was $500,000 greater than its carrying value. The equipment had an estimated remaining useful life of 10 years. 3. Each year, goodwill is evaluated to determine if there has been a permanent impairment. Goodwill had a recoverable value of $3,970,000 at December 31, Year 9 and $3,500,000 at December 31, Year 10. 4. On January 2, Year 8, Sub sold land to Par for $1,200,000. Sub purchased the land on January 1, Year 3 for $800,000. In Year 10, Par sold 30% of this land to an outsider. 5. During Year 10, Sub sold merchandise to Par for $600,000, 75% of which remains in Par's inventory at December 31, Year 10. On December 31, Year 9, the inventory of Par contained $100,000 of merchandise purchased from Sub. Sub earns a gross margin of 25% on its sales. 6. During Year 10, Par declared and paid dividends of $2,600,000, while Sub declared and paid dividends of $800,000. 7. Par accounts for its investment in Sub using the cost method. 8. Both companies pay income tax at the rate of 40%. Required a. Calculate the consolidated net income for Year 10 b. Calculate the consolidated retained earnings at January 1, Year 10. c. Prepare the consolidated financial statements for the year ended December 31, Year 10. d. Prepare the working paper elimination journal entries for the intercompany sale of inventory for Year 10

Expert Answer:

Posted Date:

Students also viewed these accounting questions

-

A surveyor wants to know the length of a tunnel built through a mountain. According to his equipment, he is located 54 meters from one entrance of the tunnel, at an angle of 56 to the perpendicular....

-

Par Corporation acquired 70 percent of the outstanding common stock of Set Corporation on January 1, 2011, for $350,000 cash. Immediately after this acquisition the balance sheet information for the...

-

Par Corporation acquired 70 percent of the outstanding common stock of Set Corporation on January 1, 2011, for $700,000 cash. Immediately after this acquisition, the balance sheet information for the...

-

For each transformation below, a C-C bond forming strategy is required to complete the synthesis. (a) Identify the C-C formation strategy that will be effective from the list below and write it on...

-

Compute the tax obligation for the following using Table 31 on page 55. a. An individual with taxable income of $59,000. b. A married couples with taxable income of $130,000. c. What is the average...

-

This case is based on an actual situation. Centennial Construction Company, headquartered in Dallas, Texas, built a Rodeway Motel 35 miles north of Dallas. The construction foreman, whose name was...

-

How and why would a country give up any of its sovereign powers?

-

Draw the network representation of the following network flow problem. MIN: +7X12 + 6X14 + 3X23 + 4X24 + 5X32 + 9X43 + 8X52 + 5X54 Subject to: - X12 - X14= -5 +X12 + X52 + X32 - X23 - X24 = +4 - X32...

-

31 The number of protons, electrons and neutrons in aluminium ion Al+ is Protons A. 27 B. 13 C. ABCD 32 32. D. 13 10 Electron 27 neutrons 14 14 14 10 14 17 14 The formula of the compound formed...

-

Cassi Taxpayer (SSN 412-34-5670) who is single, has a home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2014: Gross...

-

What merge strategy should George and Igman have used to merge the two cultures and why? Possible strategies include assimilation, deculturation, integration or separation.

-

An employee who works on the fifth floor of the headquarters of Patterson & Millers, a multinational law firm based in central London, is assigned to a new office on the eighth floor during his third...

-

Robert has entered a competition in which he must drive from his home town of Paris to London, a distance of approximately 450 km. If he arrives in 5 hours (an average speed of 90 km/h), he will...

-

Who are a firms stakeholders? Why are they important?

-

What is meant by international strategy?

-

In anticipation of Disney unveiling its theme park in Shanghai, China, the value of land surrounding the theme parks construction site sky rocketed in the first half of 2016. How do you explain this...

-

Develop your analysis using the variables in all 5 of the areas : Purpose, Non-verbal, Strategies for success, Style, and Oral strategies and tactics....

-

Which of the following streaming TV devices does not involve use of a remote controller? A) Google Chromecast B) Apple TV C) Amazon Fire TV D) Roku

-

In what way are glaciers like dirty snowballs?

-

Distinguish between mechanical and chemical weathering.

-

Name an environment where wind shapes the landscape to a significant degree.

Study smarter with the SolutionInn App