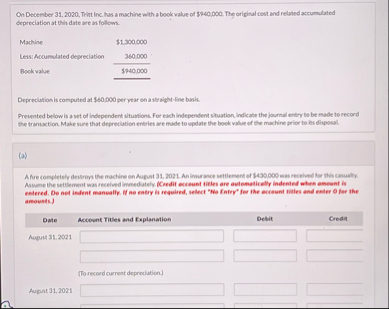

Question: On Decenter 3 1 , 2 0 2 0 , Tritt inc. has a machine with a book value of $ 9 , 9 0

On Decenter Tritt inc. has a machine with a book value of $ The oripinal cest and related accumulated depreciation at thin date are infolloms.

Machine

Less: Acoumdated depreciation

Bookvalue

$

$

Depreciation is computed at $ per year en a soraightline basis.

Pretented teelow is a vet of independent situstions For ewhindependent stuation indicate the journal entry ls be made to record the transation. Make sure that depreciation erberies wre made to update the book value of the machine prior to las disposal.

a

Afre conpletely dewrop the machine on Nupat An imurave settement of was recelved for this casually. amounts.

Date

Augun

Account TiUles and Explanation

Debit

Creda

To record current depreciation

Aupunt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock