Question: On excel please. 2 . Being frustrated about the performance of your portfolio, you decide to verify the benefits of international diversification. You have selected

On excel please.

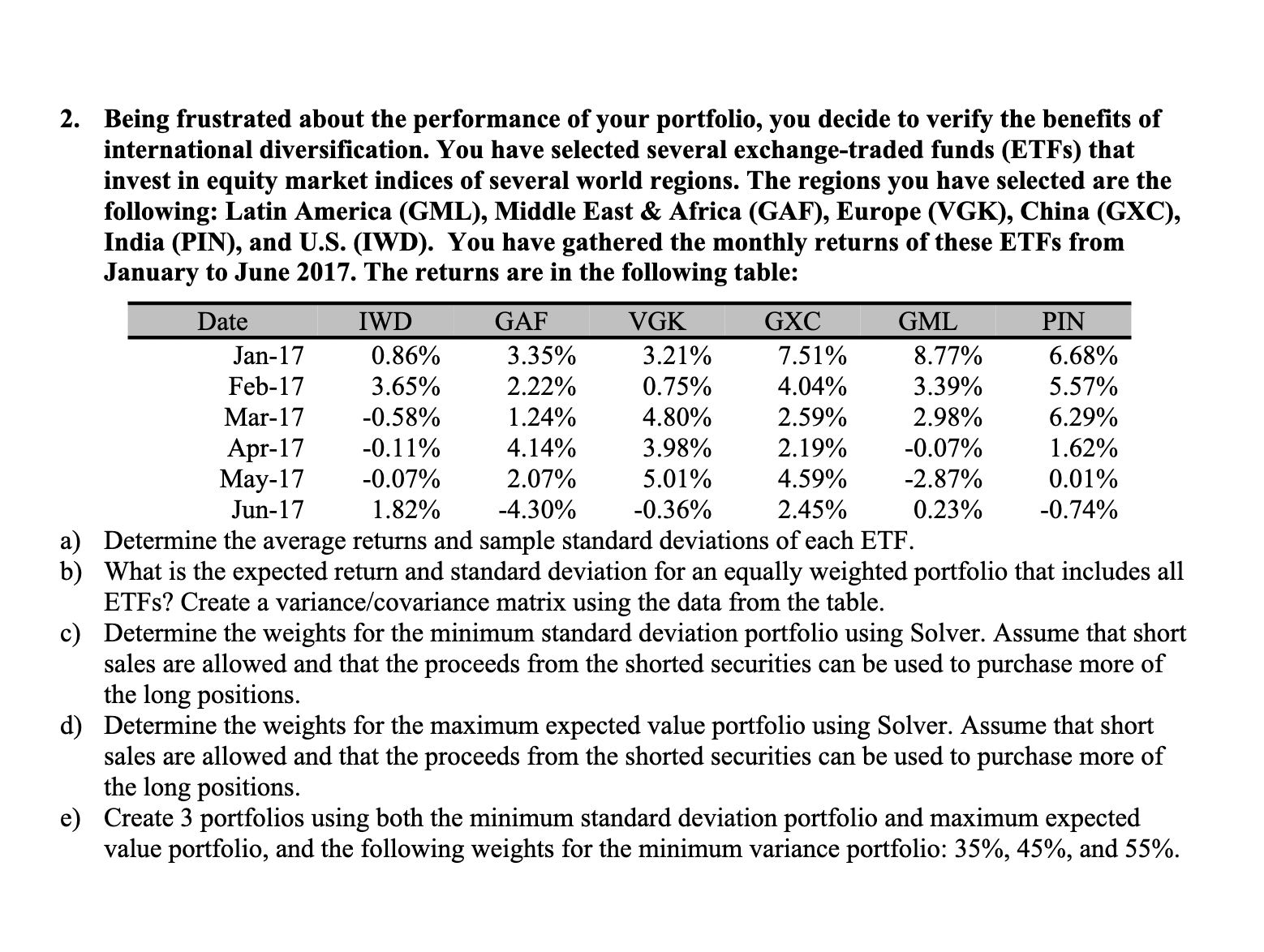

Being frustrated about the performance of your portfolio, you decide to verify the benefits of international diversification. You have selected several exchangetraded funds ETFs that invest in equity market indices of several world regions. The regions you have selected are the following: Latin America GML Middle East & Africa GAF Europe VGK China GXC India PIN and USIWD You have gathered the monthly returns of these ETFs from January to June The returns are in the following table: a Determine the average returns and sample standard deviations of each ETF. b What is the expected return and standard deviation for an equally weighted portfolio that includes all ETFs? Create a variancecovariance matrix using the data from the table. c Determine the weights for the minimum standard deviation portfolio using Solver. Assume that short sales are allowed and that the proceeds from the shorted securities can be used to purchase more of the long positions. d Determine the weights for the maximum expected value portfolio using Solver. Assume that short sales are allowed and that the proceeds from the shorted securities can be used to purchase more of the long positions. e Create portfolios using both the minimum standard deviation portfolio and maximum expected value portfolio, and the following weights for the minimum variance portfolio: and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock