Question: On February 1 , 2 0 2 3 , Marsh Contractors agreed to construct a building at a contract price of $ 1 7 ,

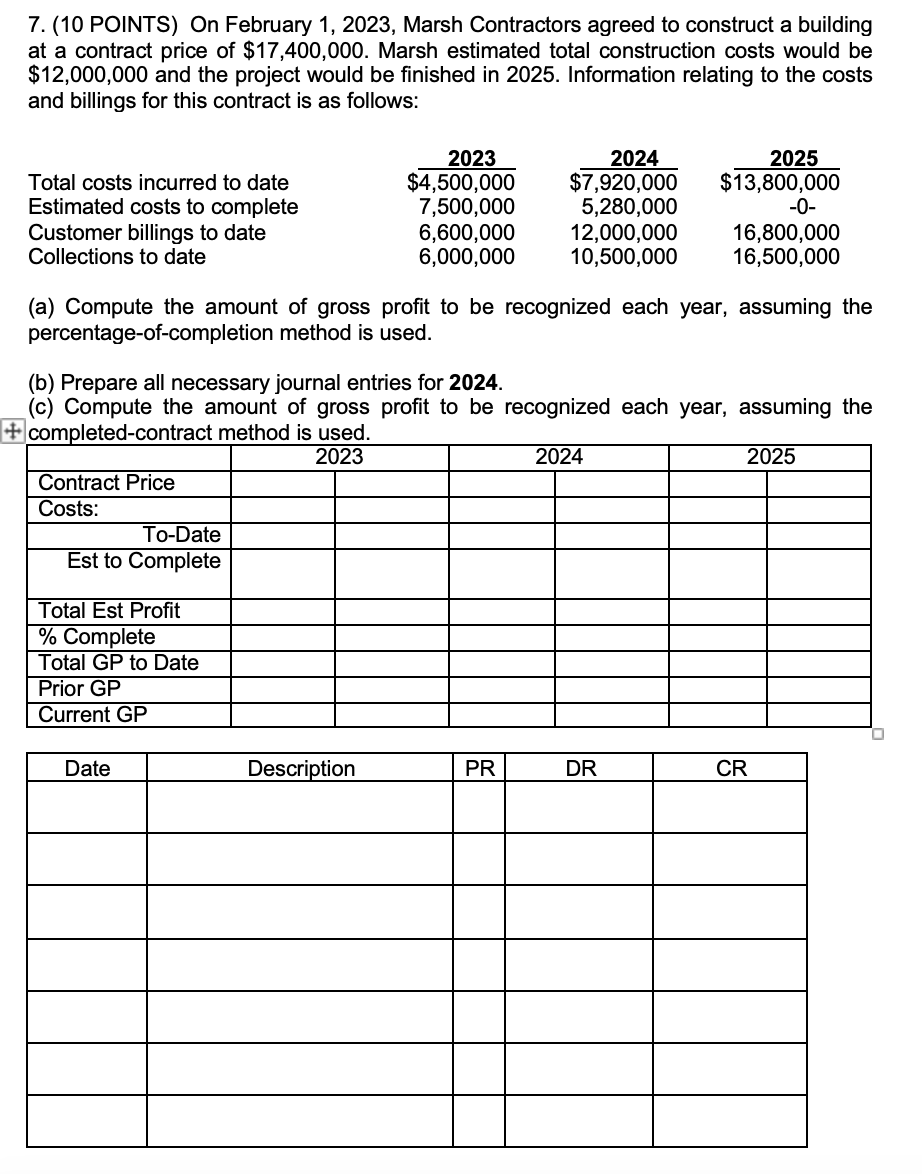

On February Marsh Contractors agreed to construct a building at a contract price of $ Marsh estimated total construction costs would be $ and the project would be finished in Information relating to the costs and billings for this contract is as follows: a Compute the amount of gross profit to be recognized each year, assuming the percentageofcompletion method is used. b Prepare all necessary journal entries for c Compute the amount of gross profit to be recognized each year, assuming the completedcontract method is used. POINTS On February Marsh Contractors agreed to construct a building at a contract price of $ Marsh estimated total construction costs would be $ and the project would be finished in Information relating to the costs and billings for this contract is as follows:

a Compute the amount of gross profit to be recognized each year, assuming the percentageofcompletion method is used.

b Prepare all necessary journal entries for

c Compute the amount of gross profit to be recognized each year, assuming the completedcontract method is used.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock