Question: On February 1 , 2 0 2 4 , Stephen ( who is single ) sold his principal residence ( home 1 ) at a

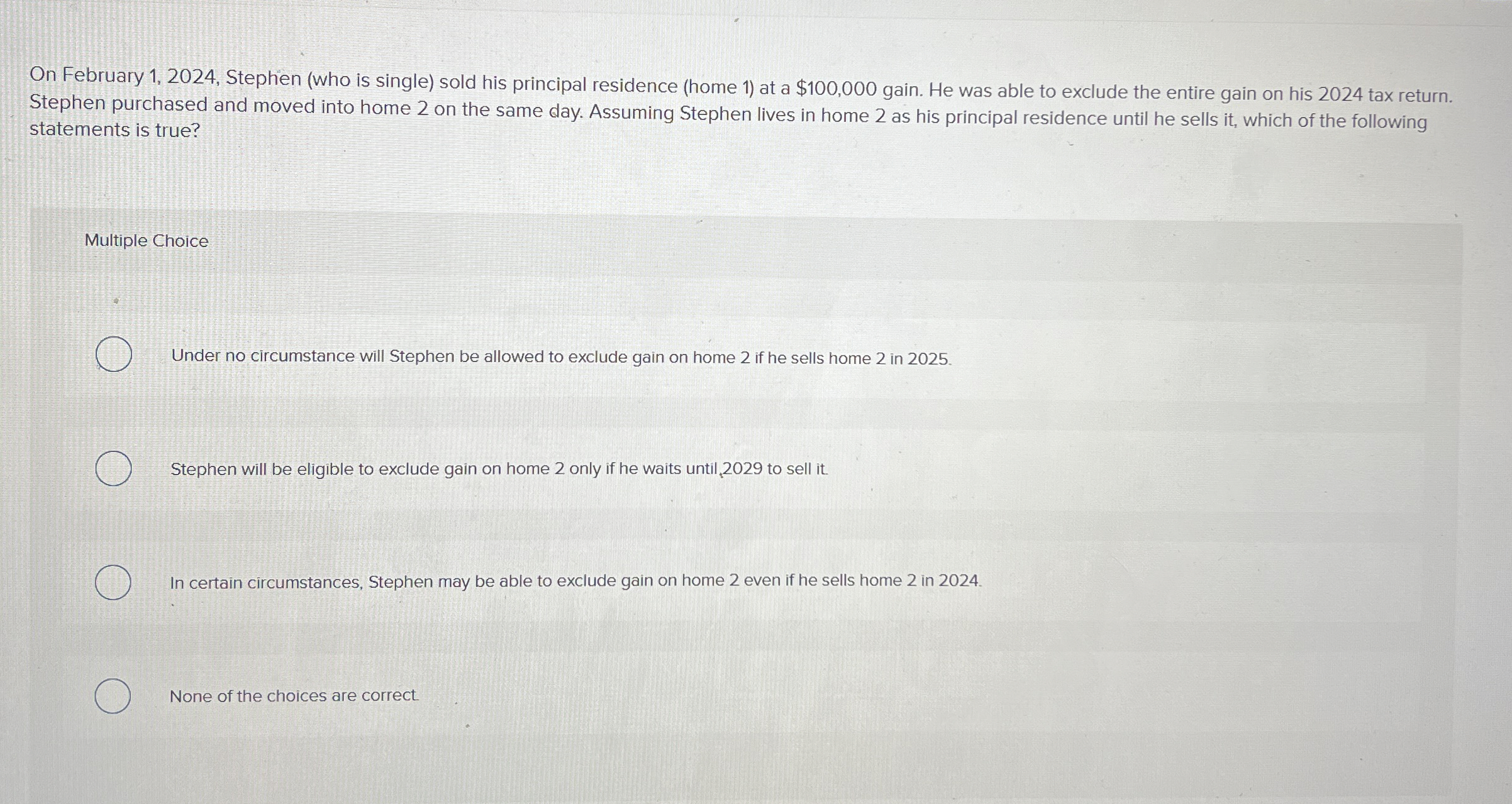

On February Stephen who is single sold his principal residence home at a $ gain. He was able to exclude the entire gain on his tax return. Stephen purchased and moved into home on the same day. Assuming Stephen lives in home as his principal residence until he sells it which of the following statements is true?

Multiple Choice

Under no circumstance will Stephen be allowed to exclude gain on home if he sells home in

Stephen will be eligible to exclude gain on home only if he waits until, to sell it

In certain circumstances, Stephen may be able to exclude gain on home even if he sells home in

None of the choices are correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock