Question: On February 2 , 2 0 1 6 , an investor held some Province of Ontario stripped coupons in a self - administered RRSP at

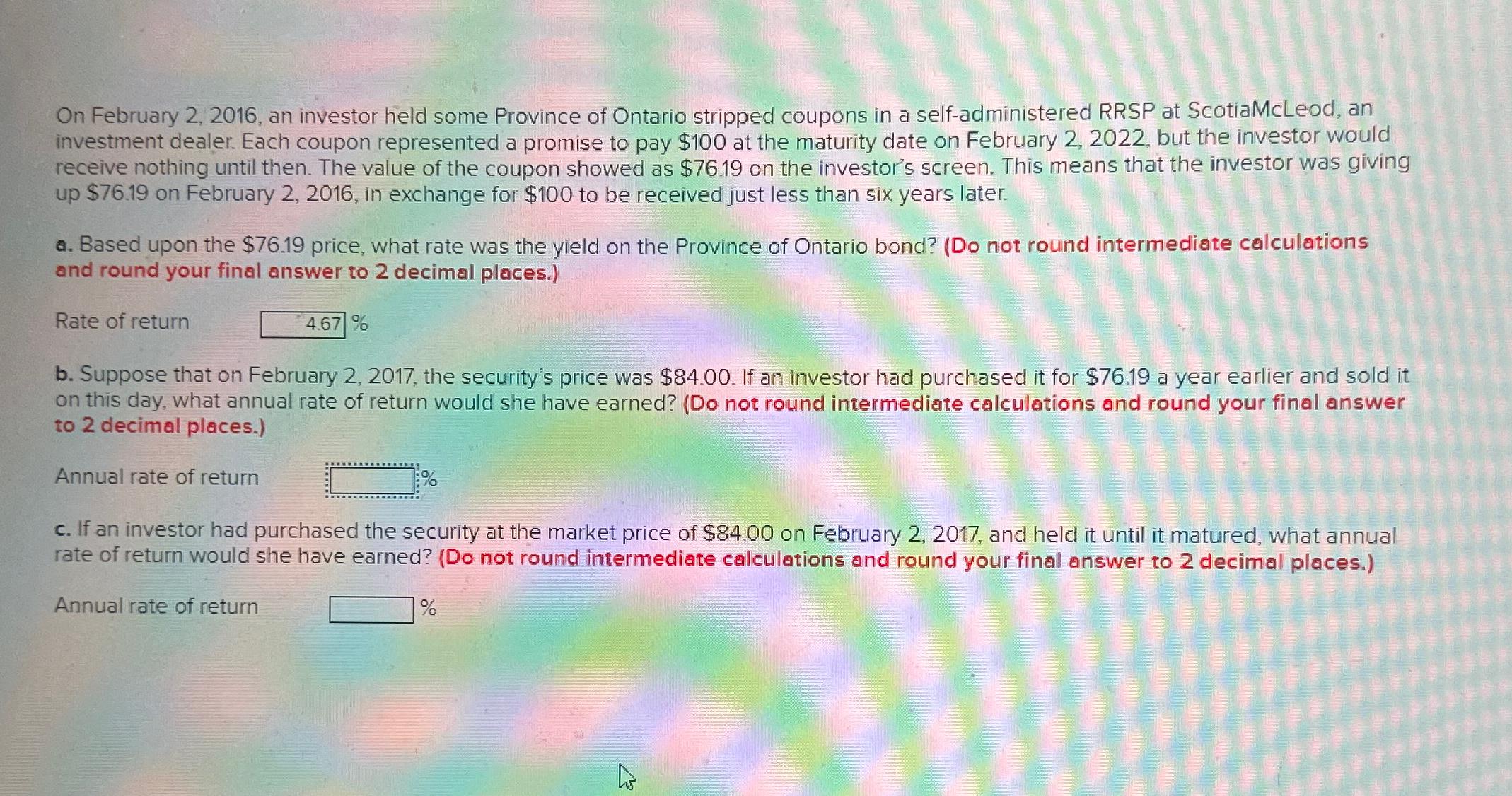

On February an investor held some Province of Ontario stripped coupons in a selfadministered RRSP at ScotiaMcLeod, an investment dealer. Each coupon represented a promise to pay $ at the maturity date on February but the investor would receive nothing until then. The value of the coupon showed as $ on the investor's screen. This means that the investor was giving up $ on February in exchange for $ to be received just less than six years later.

a Based upon the $ price, what rate was the yield on the Province of Ontario bond? Do not round intermediate calculations and round your final answer to decimal places.

Rate of return

b Suppose that on February the securitys price was $ If an investor had purchased it for $ a year earlier and sold it on this day, what annual rate of return would she have earned? Do not round intermediate calculations and round your final answer to decimal places.

Annual rate of return

c If an investor had purchased the security at the market price of $ on February and held it until it matured, what annual rate of return would she have earned? Do not round intermediate calculations and round your final answer to decimal places.

Annual rate of return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock