Question: on Help Cost of debt using both methods (YTM and the approximation formula) Currently Warren Industries can soll 20-year $1.000 par-value bonds paying annual interest

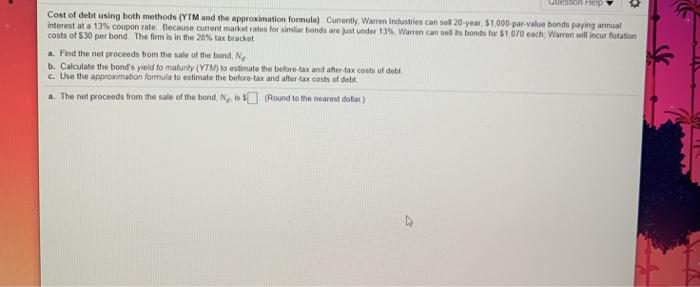

on Help Cost of debt using both methods (YTM and the approximation formula) Currently Warren Industries can soll 20-year $1.000 par-value bonds paying annual interest at a 13% coupon rate. Because current market rates for similar bonds are just under 13%, Warren can sell its bonds for $1.070 each, Warren will incur fotation costs of 530 per bond The firm in the 28% tax bracket a. Find the net proceeds from the sale of the bond N b. Calculate the bond's yield tomatunty (YTM) to estimate the before tax and after tax costs of dett c. Use the approximation formule to estimate the before tax and after tax costs of debt .. The net proceeds from the sale of the band, No (Round to the nearest dolar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts