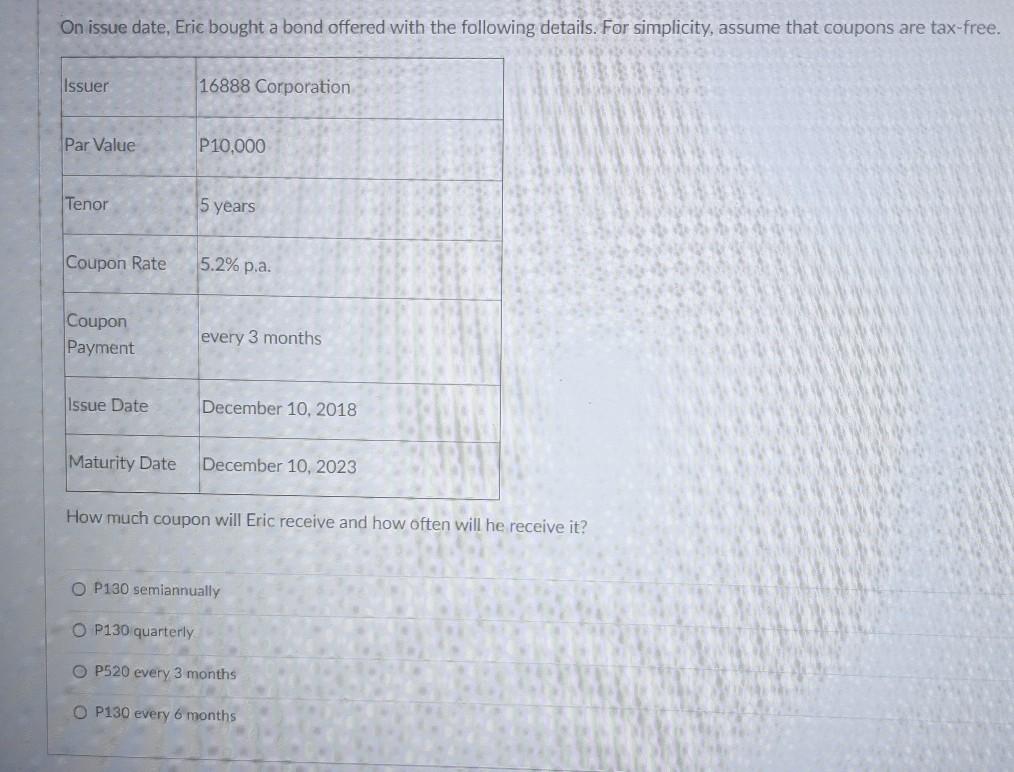

Question: On issue date, Eric bought a bond offered with the following details. For simplicity, assume that coupons are tax-free. Issuer 16888 Corporation Par Value P10,000

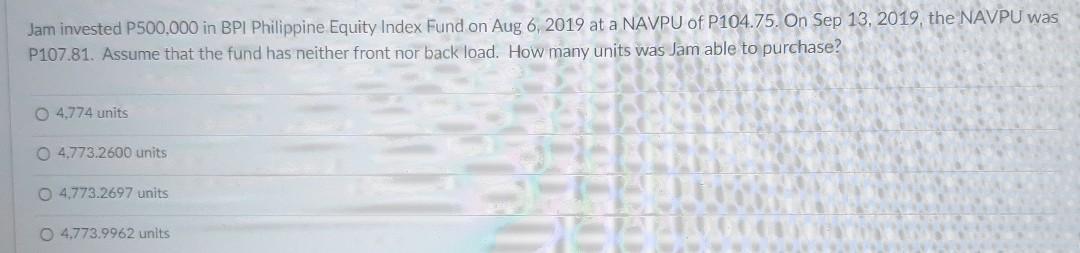

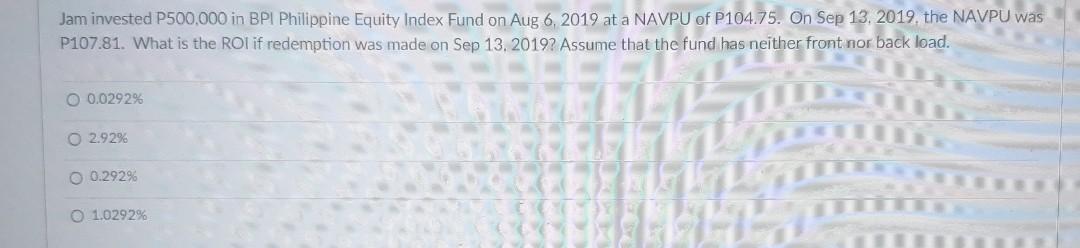

On issue date, Eric bought a bond offered with the following details. For simplicity, assume that coupons are tax-free. Issuer 16888 Corporation Par Value P10,000 Tenor 5 years Coupon Rate 5.2% p.a. Coupon Payment every 3 months Issue Date December 10, 2018 Maturity Date December 10, 2023 How much coupon will Eric receive and how often will he receive it? O P130 semiannually O P130 quarterly O P520 every 3 months OP130 every 6 months Jam invested P500,000 in BPI Philippine Equity Index Fund on Aug 6, 2019 at a NAVPU of P104.75. On Sep 13, 2019, the NAVPU was P107.81. Assume that the fund has neither front nor back load. How many units was Jam able to purchase? 0 4,774 units 4,773.2600 units 4.773.2697 units 0 4.773.9962 units Jam invested P500,000 in BPI Philippine Equity Index Fund on Aug 6, 2019 at a NAVPU of P104.75. On Sep 13, 2019, the NAVPU was P107.81. What is the rol if redemption was made on Sep 13, 2019? Assume that the fund has neither front nor back load. O 0.0292% O 2.92% O 0.292% 1.0292%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts