Question: on its year imis report support for your answer BHow inputs/support for your answer as Investment in Hamilton on its 12/310x8 balance Show inputs/ What

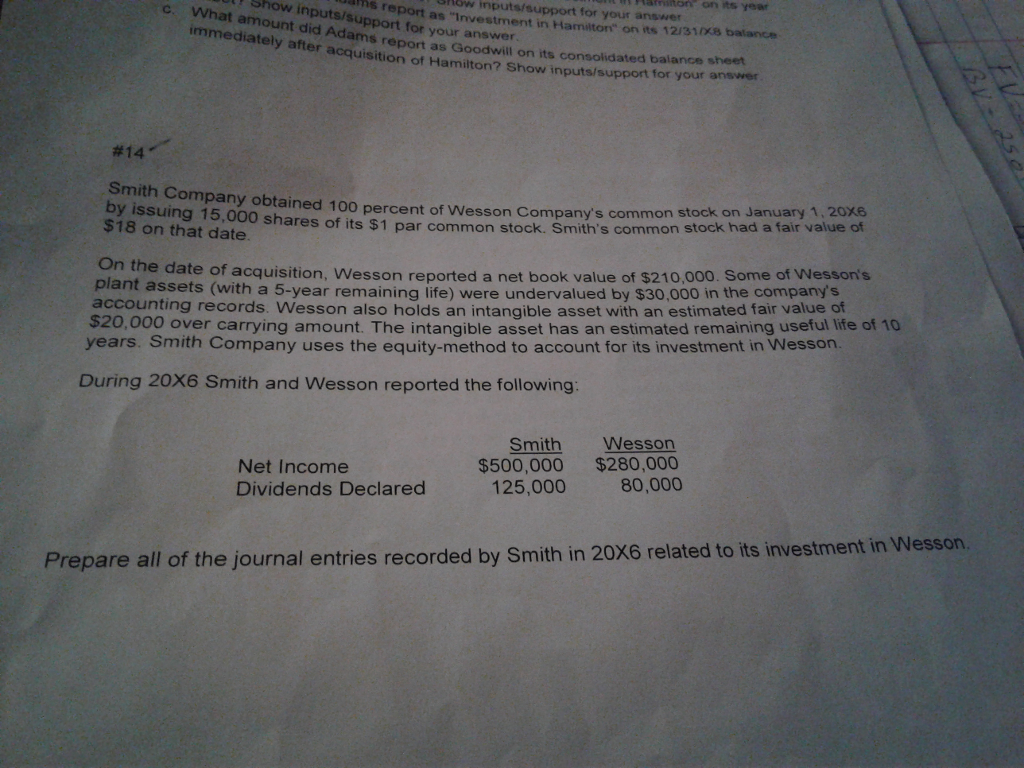

on its year imis report support for your answer BHow inputs/support for your answer as "Investment in Hamilton" on its 12/310x8 balance Show inputs/ What amount did Adams report as immediatelyafter ams report as Goodwill on its consolidated balance sheet acquisition of Hamilton? Show inputs/support for your answer #14 Smith Company obtained 100 percent of Wesson Company's common stock afair value of by issuing 15,000 shares of its $1 par comm $18 on that date on stock. Smith's common stock had a fair value of e date of acquisition, Wesson reported a net book value of $210,000. Some of Wesson's assets (with a 5-year remaining life) were undervalued by $30,000 in the company's On the accounting records. Wesson also holds an intangible asset with an estimated fair value ot $20,000 over carrying amount. The intangible asset has an estimated remaining useful life of 10 years. Smith Company uses the equity-method to account for its investment in Wesson. plant During 20X6 Smith and Wesson reported the following Smith Wesson $500,000 $280,000 125,000 80,000 Net Income Dividends Declared Pre pare all of the journal entries recorded by Smith in 20X6 related to its investment in Wesson

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts