Question: On, Jan. 1. 2018, ABC purchase a van for making deliveries to customers. Cash payments on that date are $18.500 to the sale of the

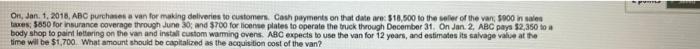

On, Jan. 1. 2018, ABC purchase a van for making deliveries to customers. Cash payments on that date are $18.500 to the sale of the van, 5900 in sales taxes: 5850 for insurance coverage through June 30 and $700 for license plates to operate the truck through December 31. On Jan 2. ABC pays $2,350 to body shop to paint lettering on the van and install custom warming ovens ABC expects to use the van for 12 years, and estimates its salvage value at the time will be $1,700. What amount should be capitalized as the acquisition cost of the van? On, Jan. 1. 2018, ABC purchase a van for making deliveries to customers. Cash payments on that date are $18.500 to the sale of the van, 5900 in sales taxes: 5850 for insurance coverage through June 30 and $700 for license plates to operate the truck through December 31. On Jan 2. ABC pays $2,350 to body shop to paint lettering on the van and install custom warming ovens ABC expects to use the van for 12 years, and estimates its salvage value at the time will be $1,700. What amount should be capitalized as the acquisition cost of the van

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts