Question: On Jan. 1, 2021, Company E purchased a machine from Company G by issuing a 12%, $10,000, three-year installment note that requires interest to

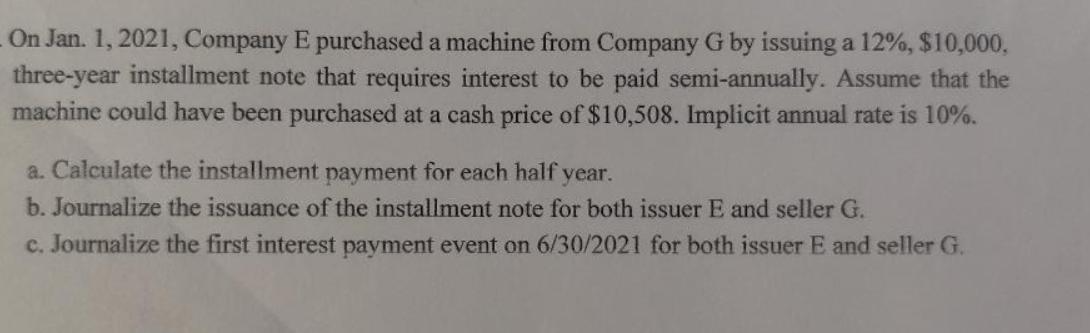

On Jan. 1, 2021, Company E purchased a machine from Company G by issuing a 12%, $10,000, three-year installment note that requires interest to be paid semi-annually. Assume that the machine could have been purchased at a cash price of $10,508. Implicit annual rate is 10%. a. Calculate the installment payment for each half year. b. Journalize the issuance of the installment note for both issuer E and seller G. c. Journalize the first interest payment event on 6/30/2021 for both issuer E and seller G.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

ANSWER My Textboa a Solutions 10000 12 Note Payable On 3 Installments Cash Price 10518 Implicit Annu... View full answer

Get step-by-step solutions from verified subject matter experts